This article is part of a series, “Navigating the Complexities of Setting Up a Business in the USA”. View all the articles in the series here.

Key Takeaways:

- Follow U.S. tax requirements by understanding federal, state, and local obligations.

- Adjust your business strategy for the U.S. market by accounting for sales tax variations.

- Utilize tax treaties to minimize tax burdens and navigate international tax rules effectively.

~

Navigating the U.S. tax system is a critical aspect of doing business in the United States. Unlike other countries with a single national tax system, the U.S. has a multi-layered structure that includes federal, state, and local taxes. Each layer has its own set of regulations and compliance requirements, which can be varied and complex.

For foreign businesses, this system can be challenging — especially if you are accustomed to a more centralized tax framework. In the U.S., tax obligations can arise not only from physical presence but also from sales or services delivered into a state, requiring your business to report to multiple agencies. It is important to recognize these distinctions for both compliance and tax strategy.

Federal Tax Obligations

What creates a taxable presence for federal income taxes is uniform across the country. Your business must file annual income tax returns with the Internal Revenue Service (IRS), detailing your income, expenses, and tax liabilities. Federal taxes include corporate income taxes, certain payroll taxes, and other specific levies.

While federal taxes are uniform across the country, they may be overridden by an enforceable income tax treaty (more on those below). The uniformity of federal taxation is also, unfortunately, not consistent for state taxation.

State and Local Tax Considerations

State and local taxes vary significantly across the U.S. Individual states can impose income taxes, sales taxes, property taxes, and other business-related taxes on your company. The complexity is further compounded by the fact that different authorities may have unique regulations about what triggers tax obligations — such as physical presence, sales volume, or the delivery of services.

The triggers at the state level do not necessarily coincide with the federal triggers. This can be both an opportunity for tax planning for your company and a potential pitfall if you are not careful.

Value-Added Tax Versus Sales Tax

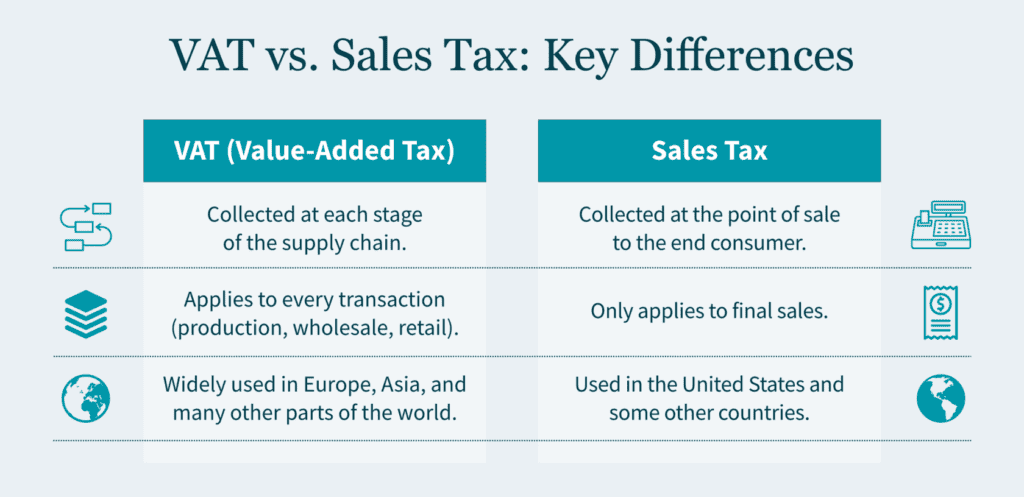

Unlike the value-added tax (VAT) systems in many other countries, the U.S. sales tax system varies widely from state to state. While businesses in places like Europe often deal with a single national VAT system, the U.S. requires navigation through state and local sales tax regulations — each with its own rates and rules, creating a complex compliance landscape.

While VAT is a tax applied at each stage of the supply chain based on the added value, U.S. sales tax is typically collected only at the ultimate point of sale to the end consumer. This distinction can influence pricing strategies, cash flow management, and overall tax planning for your business.

Impact of Income Tax Treaties

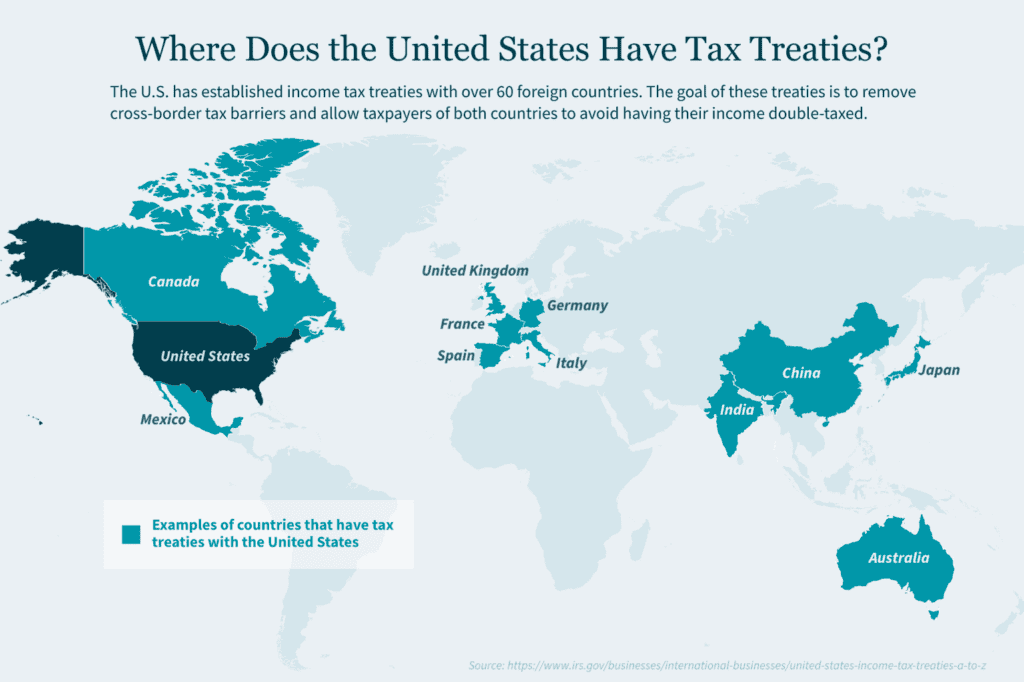

Tax treaties between the U.S. and other countries can influence how your foreign business is taxed. These treaties often provide benefits such as reduced tax rates, exemptions from certain taxes, or simplified compliance requirements. However, they require careful navigation for proper application. The presence of a tax treaty between the U.S. and your home country can affect how you should structure your business operations when entering the U.S. market.

Tax treaties aim to avoid double taxation and ease international trade. They typically cover aspects like income tax on royalties, dividends, interest payments, as well as defining what constitutes a taxable presence. Understanding these treaties is essential for improving tax liabilities and staying compliant with regulations in both the U.S. and your home country.

Navigating U.S. Taxes for Your Foreign Business

Successfully managing U.S. taxes requires a comprehensive understanding of federal, state, and local tax obligations, the nuances of sales tax versus VAT, and the strategic use of income tax treaties. To optimize your tax position and minimize compliance risks, you should prioritize thorough planning and seek professional advice.

How MGO Can Help

MGO’s International Tax team can help you navigate these complexities and develop effective strategies for your U.S. operations. Our experienced team can assist you with tax planning, compliance, treaty analysis, and structuring your business for optimal tax efficiency. For more detailed insights and help, reach out to our team today.

Setting up a business in the U.S. requires thorough planning and an understanding of various regulatory and operational challenges. This series will delve into various aspects of this process, providing guidance and practical tips. Our next article will discuss choosing the right business structure for your U.S. expansion.