Key Takeaways:

- Businesses operating internationally should regularly review transfer pricing practices — including documentation, benchmarking, and IRS reporting requirements.

- Understanding the classification of inter-company transactions, learning from past audits, and considering Advance Pricing Agreements can improve tax compliance and strategy.

- Regular assessment of transfer pricing practices can help maintain compliance, mitigate risks, and potentially reveal cost-saving opportunities.

—

For today’s global businesses, understanding and managing the complexities of international tax and transfer pricing can be a challenge. That’s why it is important to regularly review your practices against critical standards to maintain compliance and improve tax strategies.

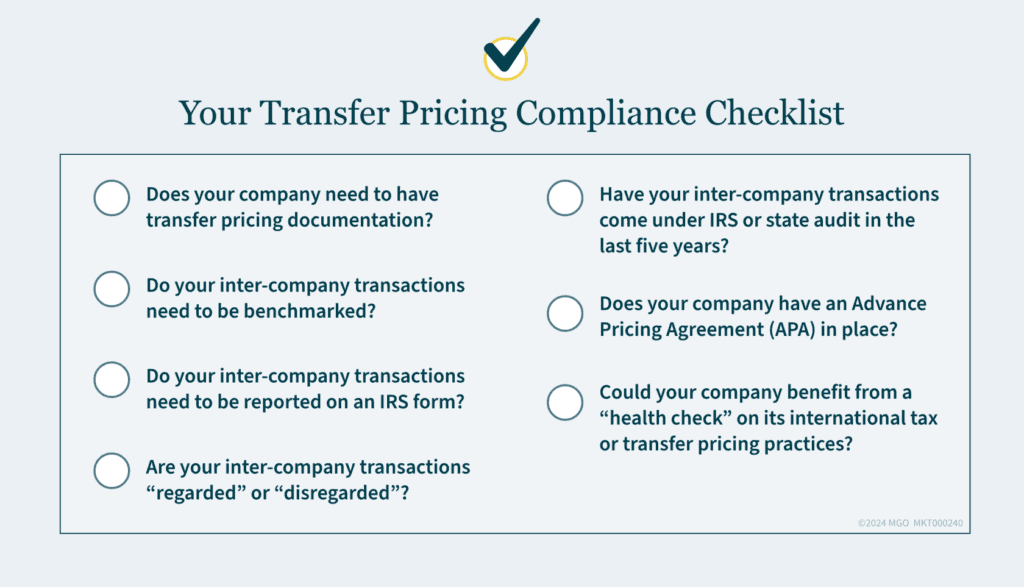

To help you determine if your company is compliant or if consultation may be needed, use this straightforward checklist based on key questions about your operations:

- Does your company need transfer pricing documentation? Transfer pricing documentation is essential to show your company’s pricing policies follow local and international arm’s length standards. This documentation should include detailed analyses of inter-company transactions, the methods used to set prices, and how these follow applicable tax laws. Having robust documentation can help you prevent disputes with tax authorities, avoid potential tax penalties, and make audits run smoother.

- Do your inter-company transactions need to be benchmarked? Benchmarking is the process of comparing your inter-company transactions with those of similar transactions by unrelated parties to confirm the inter-company pricing is at arm’s length. This process involves gathering data from uncontrolled comparable companies and transactions to justify your pricing strategies. Effective benchmarking helps maintain compliance and supports your transfer pricing documentation.

- Do your inter-company transactions need to be reported on an IRS form? Certain inter-company transactions must be reported to the IRS to follow regulations and avoid penalties. For instance, transactions with foreign affiliates often require filling out Form 5472. Regularly reviewing which forms are applicable and accurately reporting transactions can help you stay compliant and avoid fines. In addition, your company may have offshore investments that may require reporting on IRS Forms 5471 and/or 8621.

- Are your inter-company transactions “regarded” or “disregarded”? (Consider if some are regarded and others are disregarded.) The tax treatment of inter-company transactions can vary, with some being regarded and others disregarded. Understanding which transactions fall into each category is vital for proper tax planning and compliance as it affects income allocations and taxable earnings calculations.

- Have your inter-company transactions come under IRS or state audit in the last five years? If your transactions have been audited, it’s important to review the outcomes and learn from them. An audit history can show potential areas of risk in your transfer pricing practices. Reviewing and adjusting practices based on past audits can help reduce the likelihood of future audits and potential penalties.

- Does your company have an Advance Pricing Agreement (APA) in place? An APA is an agreement between a taxpayer and tax authorities that pre-approves transfer pricing methods the taxpayer will apply for future inter-company transactions. Having an APA can reduce uncertainty in tax matters, prevent disputes, and provide clarity on how transactions will be treated. If you don’t have an APA, it might be time to consider whether it could help your operations.

- Could your company benefit from a “health check” on its international tax or transfer pricing practices? A tax “health check” involves a comprehensive review of your company’s tax and transfer pricing practices to find areas for improvement and potential risks. This proactive approach can help your company improve its tax strategies, verify compliance, and potentially uncover cost-saving opportunities.

Is Your Business Meeting Transfer Pricing Compliance Standards?

By answering the questions above, you can identify areas where your company may need to improve its transfer pricing and international tax practices. Addressing these key areas will help you develop more effective strategies to mitigate your risks.

How MGO Can Help

We are committed to helping you navigate the complex world of international tax and transfer pricing. With our comprehensive approach, we address each area of potential concern — from correct documentation and effective benchmarking to navigating IRS reporting requirements and understanding the tax implications of every transaction.

Whether you are looking to set up an APA or simply need a thorough “health check” of your current practices, our team is here to provide the support and insights necessary to improve your tax strategies and enhance your operational efficiency. Reach out to our team today.