Key Takeaways:

- Vineyards and wineries often navigate sales and use tax requirements in multiple jurisdictions, with different rules, rates, and exemptions in each state.

- Promotional activities, such as “buy one, get one free” offers, hosting wine tastings, and online advertising can unknowingly create use tax exposure.

- Sales tax compliance software often doesn’t address excise and gross receipts taxes, such as Washington’s B&O tax and Ohio’s CAT.

—

Navigating state and local taxes (SALT) is challenging for any business that sells across state lines, but it can be particularly challenging for vineyards and wineries.

Various excise, sales and use, and gross receipts taxes can apply in different jurisdictions. Not following the complex web of tax rules and regulations can lead to audits, penalties, and even the loss of your license. Fortunately, with the right guidance, you can follow the various state and local tax requirements and even reduce your tax burden.

Understanding Sales and Use Tax Registration and Licensing

Sales and use tax registration and licensing requirements vary by state and depend on whether you ship products directly to consumers. Not all states allow direct-to-consumer shipping, adding another layer of complexity.

Evaluating your sales and use tax exposure requires answering several questions:

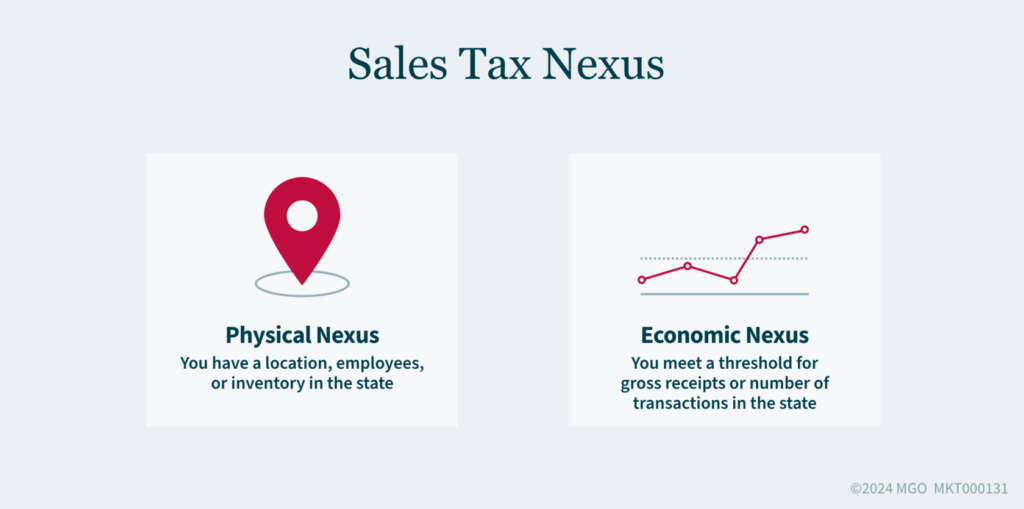

- In which state and local jurisdictions do you have nexus? Sales tax nexus is a connection between your business and a tax jurisdiction that allows the state or local government to impose sales tax on your business. Most states levy a sales tax, and some, including California, Louisiana, and Tennessee, allow localities to impose their own taxes. You can have physical nexus in a jurisdiction by having employees or a location in the area or economic nexus by meeting a threshold for gross receipts or number of transactions.

- Are you properly registered and paying taxes in that jurisdiction? Some industries might gamble on the cost-benefit analysis of registering and paying sales tax in multiple jurisdictions, but vineyards and wineries must prioritize compliance to maintain their licenses. If your winery has a license or distributes alcohol products in a state, it has nexus and should comply with all relevant tax obligations — regardless of economic thresholds.

- Are you taking advantage of sales and use tax exemptions in each jurisdiction? Exemptions differ by state. For example, California offers a partial sale and use tax exemption for winery equipment used in manufacturing — such as grape crushers, de-stemmers, presses, bottling equipment, and fermentation tanks. Many states also offer resale exemptions, allowing winemakers to purchase tax-free raw materials like citric acid.

- Do you have the proper documentation in place? If you take advantage of exemptions, you must have the right documentation. Without proper records, selling the business or facing a sale and use tax audit can be complicated and costly.

A reverse sales tax audit can help you answer these questions. During a reverse sales tax audit, a professional reviews your invoices and purchase orders, researches applicable laws, and thoroughly documents your exemptions. A reverse sales tax audit can also help assess whether you have overpaid sales tax due to missing available exemptions. If that is the case, you can review prior returns, find potential overpayments, and file amended returns to secure refunds.

Unique Vineyard and Winery Sales Tax Issues

The nature of the wine business brings some unique challenges to sales and use tax compliance. Here are a few issues to consider:

Promotions and Use Tax

Many wineries conduct “buy one, get one free” offers without realizing they must pay use tax on the free item and remit it to the state.

Often, a simple change of wording in the promotion, like changing it to “Buy 2 and get 50% off the total,” can eliminate use tax exposure.

Store Displays

Another area of concern is giving displays to stores. If the winery doesn’t sell the display to the store, the winery IS the final customer. If the winery didn’t pay sales tax on the display purchase, it must report and pay use tax on the item.

Event Marketing and Advertising

Many vineyards and wineries deploy sales representatives to host events without realizing this can create physical nexus in many states.

Examples include hosting wine tastings, holding educational events, and participating in festivals and music events.

Even online advertising can unintentionally establish nexus, so it’s crucial to work with an advisor who understands the industry and can help you find potential sales and use tax exposures.

Excise Taxes and Gross Receipts Taxes

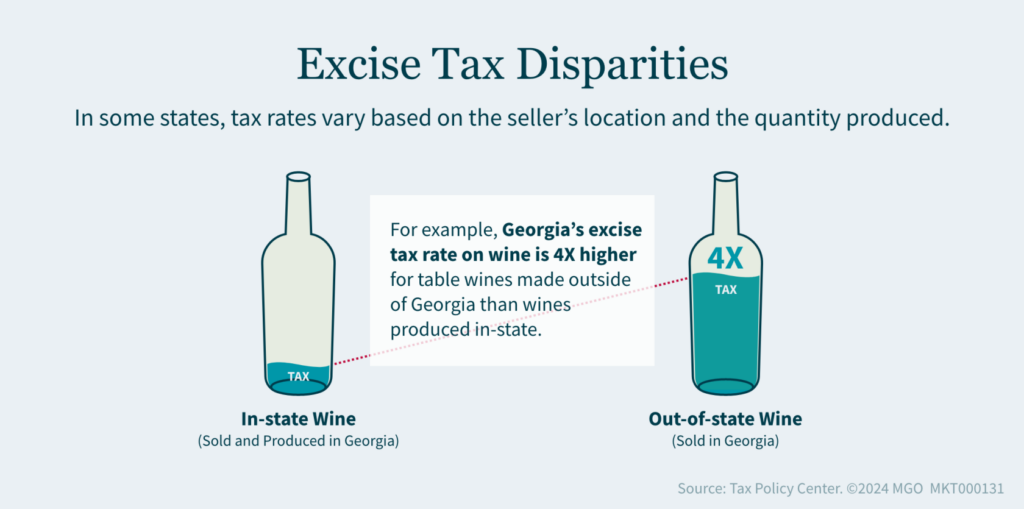

Sales and use taxes aren’t the only taxes vineyards and wineries need to consider. Many states also levy excise taxes and/or gross receipts taxes. These are often more aggressive than sales tax because they’re levied on gross receipts with minimal exemptions. Some examples include:

- Washington’s business & occupation (B&O) tax

- Ohio’s commercial activity tax (CAT)

- Texas franchise tax

- Tennessee business tax

While excise and gross receipts taxes often have low rates, they can add up over time if not addressed promptly.

Don’t assume full compliance because you use sales tax compliance software. Some popular tax compliance solutions do not cover gross receipts taxes like Washington’s B&O tax, leading to potential oversights.

How We Can Help

From compliance with sales and use tax requirements to identifying and documenting relevant exemptions, MGO’s State and Local Tax team can review if your vineyard or winery still is compliant and doesn’t overpay your state and local tax liability.

Contact us today for help determining compliance and identifying potential tax-saving opportunities.