Executive Summary:

- The SEC has proposed new regulations regarding climate-related disclosures, which impact reporting for public registrants.

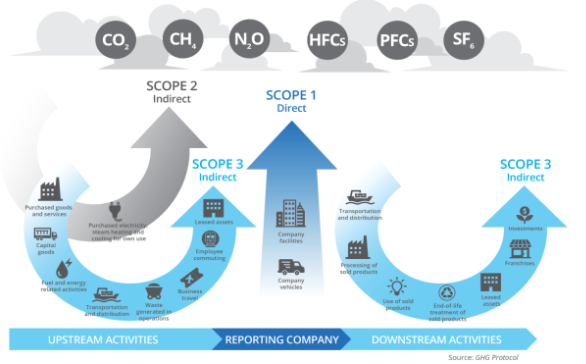

- The proposed rules will involve calculating and reporting Scope 1,2, and 3 greenhouse gas emissions.

- If these proposed SEC guidelines are enacted, privately held companies that are contracted suppliers or vendors to public companies will have to report GHG data as part of their Scope 3 calculations.

In March 2022, the U.S. Securities and Exchange Commission (SEC) proposed new regulations specific to climate-related disclosures which would impact reporting obligations for public registrants. A key component of the proposed rules (refer to pages 41-45 of the 506 page proposal for the analysis) involves calculating and reporting Scope 1, 2, and 3 greenhouse gas (GHG) emissions.

For anyone unfamiliar with the concept of Scope 1, 2, and 3 GHG emissions, our Environmental, Social and Governance (ESG) practice breaks down what they are, why they are important, and what you can do to start inventorying, measuring, and ultimately reducing your company’s emissions impact.

Understanding the difference between Scope 1, 2 and 3 GHGs

In order to define Scope 1, 2, and 3 emissions, companies must first look to the most common standards and frameworks.

For example, while the International Organization for Standardization (ISO) has provided a general set of standards (through ISO 14064); however, the Greenhouse Gas Protocol (GHG Protocol) has emerged to provide “accounting and reporting standards, sector guidance, calculation tools and trainings for businesses and local and national governments” and has “created a comprehensive, global, standardized framework for measuring and managing emissions from private and public sector operations, value chains, products, cities and policies to enable greenhouse gas reductions across the board.”

Further, the SEC notes on page 34 of their proposed rule, that the GHG Protocol “has become a leading accounting and reporting standard for greenhouse gas [GHG] emissions” with “concepts and a vocabulary that are commonly used by companies when providing climate-related disclosures.”

As such, the SEC has grounded the proposed rules in line with the following definitions established by the GHG Protocol:

Scope 1 GHG Emissions:

Direct emissions that occur from sources owned or controlled by the company - such as fuel combustion from buildings, vehicles, machinery, and other equipment.

Scope 2 GHG Emissions:

Indirect emissions resulting from the generation of electricity purchased and used by the company (derived from the activities of the power provider). This includes purchased electricity, heat, steam, and cooling.

Scope 3 GHG Emissions:

All other indirect emissions which are not captured in the Scope 2 category. Scope 3 emissions are generated as a result of a company’s value chain but are not directly owned or managed by the company. For example:

- Upstream emissions include but are not limited to goods and services purchased from vendors and suppliers; upstream transportation and distribution; business travel; and employee commuting.

- Downstream emissions include but are not limited to transportation and distribution to customers; the processing of sold products; the use of sold products; sold products’ the end-of-life treatment; and investments.

Given the scope and scale, Scope 3 emissions are significantly more complex and time consuming to inventory, calculate, track, and manage compared to both Scope 1 and Scope 2 emissions.

Why measuring greenhouse gas emissions is important

The SEC’s proposed rule has its most immediate impact on public companies; however, private companies that operate in the value chain for public companies impacted by the proposal need to consider their own GHG emissions calculations.

For example, if the SEC guidelines are put in place and include Scope 3 reporting requirements as currently written (i.e., based on materiality or linkage to commitments), privately held companies that are contracted suppliers or vendors to public companies impacted by the proposed rule are likely to receive recurring requests (i.e., at least annually) for complete, accurate, and timely GHG data, which the public company will include as part of their upstream Scope 3 calculation.

As such, an inability to furnish complete, accurate, and timely GHG data may become a barrier for entry to becoming a supplier or vendor to certain public registrants.

Attestation of GHG reporting

With the SEC’s proposed climate-related disclosure rules, GHG emission information will need to be validated through third-party attestation.

Per the proposed rule, the attestation requirements for GHG emissions metrics would:

- Pertain to Scope 1 and Scope 2 only (i.e., any Scope 3 disclosures would not be subject to the attestation requirement and would be protected through a safe harbor provision)

- Impact large accelerated and accelerated filers only (i.e., non-accelerated and/or smaller reporting companies [SRCs] would not be required to comply with the attestation requirements)

- Define a set of minimum attestation report requirements, including acceptable attestation frameworks

- Include a phase-in period with a compliance date dependent on the registrant’s filing status

It should be noted that the proposed rule also allows impacted registrants to transition into the reasonable assurance attestation requirement by initially subjecting the new GHG emissions disclosures to a limited assurance review. Both reasonable and limited assurance engagement and reporting requirements are defined at length by various organizations (including the AICPA); however, impacted registrants need to understand that a limited assurance review is considered “substantially less in scope" than an examination performed under reasonable assurance (i.e., impacted registrants need to ensure they are taking appropriate steps to ensure that their GHG emissions disclosures are robust, in all material respects).

Greenhouse Gas strategy for state and local governments

Measuring Scope 1, 2, and 3 GHG emissions is not only applicable for businesses — leaders of state and local government institutions are also under growing pressure to inventory, measure, and disclose ESG-related metrics and key performance indicators (KPIs), including GHG emissions disclosures.

As a result, the GHG Protocol has also developed an accounting and reporting standard for cities.

MGO's perspective

Regardless of your ESG program’s maturity, the definition of value is evolving, and organizations that keep pace are primed for long-term success. If you are interested in inventorying, measuring, and reporting Scope 1, 2, and 3 GHG emissions, contact us to get started.

For insights tailored to your company and industry, schedule a conversation with our ESG team today.