Tax credits and incentives are an often underutilized, yet powerful tool to help you improve your bottom line and reinvest in your business – all while substantially reducing your tax exposure.

In recent years, a number of firms have emerged specializing in credits and incentives and building large businesses by over-promising and under-delivering these tax consulting services. While credits and incentives are enticing, they must be handled with extreme care, as the consequences of getting it wrong can be serious.

At MGO, we not only help you determine if you are eligible for these valuable tax credits and incentives, but we also perform damage control and clean-up following bad actors’ broken promises and sloppy work. We have seen firsthand the fallout from their poor performance and how it affects clients. In this article, we will help you understand what to look for in a tax credits and incentives provider and recognize and avoid IRS red flags so you can safely capitalize on these opportunities.

An Overview of Tax Credits and Incentives

Designed to encourage investment and development, job creation, growth, and certain business activities, tax credits and incentives provide an opportunity to reduce the amount of tax owed for performing certain activities. Credits and incentives are categorically different than tax deductions, which reduce the amount of taxable income.

These incentives often target desirable industries or activities like research and development, job creation for at-risk populations, and expanded growth in underdeveloped areas. When leveraged correctly, credits and incentives can be a powerful tool to funnel back resources into your organization to fuel activities you are already doing. Even more enticing, these credits can often apply retroactively if you determine you qualify for certain credits or incentives after the fact.

There are three basic types of tax credits: nonrefundable, refundable, and partially refundable. Here, we break down just a few of the different types of tax credits pertaining to businesses in different classifications, industries, or activities performed:

R&D Tax Credits

Designed to incentivize innovation, this dollar-for-dollar tax savings has both federal and state-level implications and can save you up to 15% on qualifying activities. To claim an R&D tax credit, your company must pass a four-part test and be involved in the technical development of new or improved products or processes. This can apply to product enhancements, product development, software development, process improvements, and more.

Employee Retention Tax Credit (ERTC)

The ERTC was created to provide much-needed financial relief for businesses affected by the COVID-19 pandemic. With complex eligibility requirements, the refundable tax credit awards qualifying employers with a payroll tax credit of up to $26,000 per employee as an incentive to retain them on payroll through potential closures, quarantines, and other hardships. Since its rollout, the ERTC has been expanded to continue providing relief to an even larger group of employers, even retroactively (albeit with a smaller maximum amount per employee for 2021).

IRC Section 179D

This popular tax incentive gives designers, builders, and building owners the opportunity to obtain a tax deduction of up to $1.80 per square foot if they install eligible energy efficient buildings and systems that reduce the power and energy costs by 50% or more compared to the minimum standard requirements. Tenants are eligible if they make the construction changes, and the deduction can be claimed on both retrofits and new construction projects. Buildings that qualify include commercial buildings like parking garages and warehouses, government-owned buildings like universities and libraries, and apartment buildings with four stories or more.

Work Opportunity Tax Credit (WOTC)

A federal tax credit for employers looking to invest in American job seekers who face barriers to acquiring employment, the WOTC is claimable if the employer 1) meets their business needs, and 2) does so by hiring an employee from a WOTC targeted group (which include veterans, ex-felons, and qualified long-term unemployment recipients, among others). An employer interested in claiming this credit must verify the new hire is a member by applying and receiving a certification.

Risks Associated with Claiming Tax Credits and Incentives

While there are many benefits to tax credits and incentives, there are a few risks attached to claiming them on your tax return.

One risk is exposing your organization to an IRS audit. An audit does not always mean trouble — at least, not if you are doing everything right — but having to go through the process of complying means you are devoting time and effort to something that yields no financial value, ultimately draining resources from more conducive business activities. Working with IRS representatives and organizing and submitting documentation is labor-intensive.

A significant issue to note is that if you overstate your credits, the IRS’s software may flag the subsequent higher score for the return, sparking an audit — so claim succinctly and accurately. Then, of course, there is the issue of an audit exposing issues unrelated to your tax credits, making you vulnerable to even bigger problems.

Another risk is payback. Tax credits do not have payback requirements, but some tax incentives do, and along with them come penalties for failing to pay in a timely manner. You may also then accrue interest, which can add up quickly. This negates the incentives in the first place, only causing a bigger headache.

Red Flags to Look for in Tax Credit and Incentive Providers

To maximize the potential of the credits, working with a certified public accounting (CPA) firm is absolutely essential. Non-CPA firms do not have to adhere to strict accounting guidelines. Additionally, they may not have the requisite experience or perspective to assess your situation holistically. A trained and licensed professional will examine your operations, uncover missed opportunities, and help you capitalize on a lower tax liability. But choosing unwisely can have major ramifications and increase your chances of being audited by the IRS.

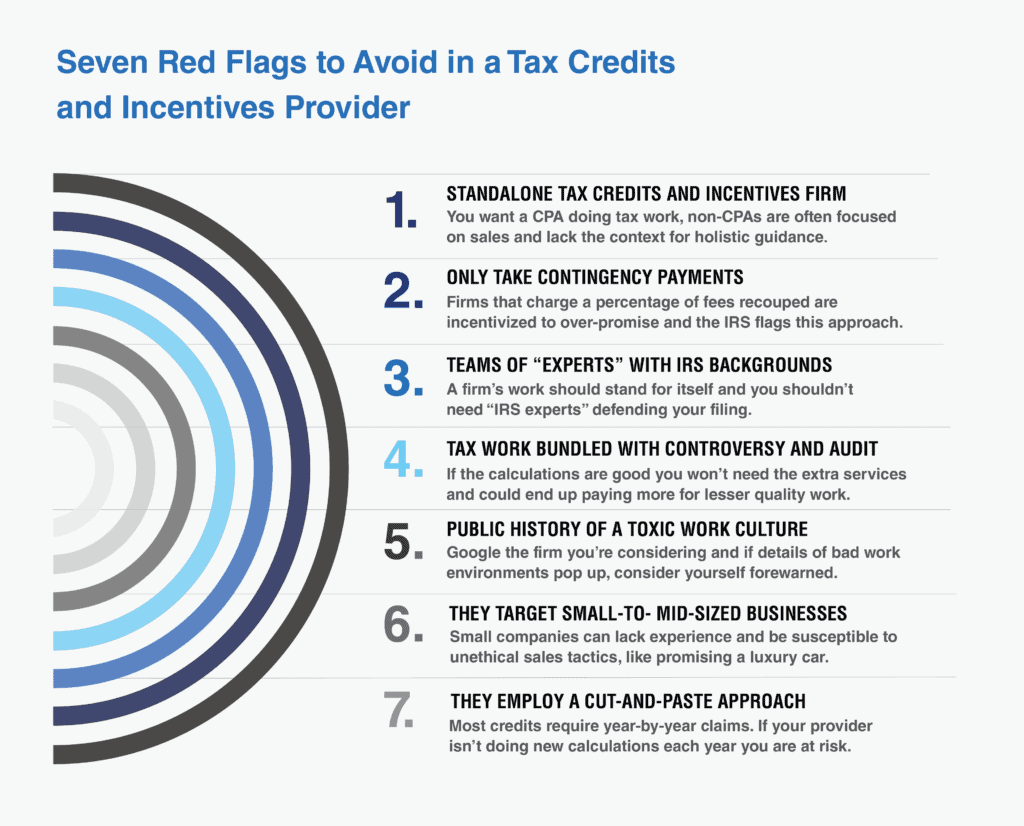

Here are some of the most important red flags to look for when selecting a provider:

1. Standalone Tax Credits and Incentives Firm

Firms that do not utilize CPAs often use lower-cost, less-experienced recent graduates who act more in a sales-focused capacity than as an accountant. This lack of knowledge and background in accounting fundamentals can result in you being misled by someone who is not equipped to help with complex tax matters.

2. They Only Take Contingency-Based Payments

Stay away from firms that take 25-35% of the savings recouped in fees. This is a sales approach that is commission-based by maximizing your credit, and you can assume they are being incentivized by these fees to over-promise — which means they will almost certainly underdeliver. Another negative? If an auditor sees your tax provider takes contingency-based payments, they will automatically assume they are acting in bad faith and then comb through your past credits to verify their accuracy. And they can look through your last three tax returns, making you even more vulnerable.

3. They Market a Team of “Experts” with IRS or Legislative Backgrounds

Look out for firms that tout their employees as experts who have specialized backgrounds tailored to helping you get your tax credits. Whether or not they actually have IRS or legislative backgrounds, at the end of the day, a firm’s work should speak for itself. There is no need for flashy marketing collateral that boasts expertise without proof.

4. They Bundle Tax Work with Controversy and Audit Support

A combo deal is great when it is a burger, fries, and a Coke, but when it comes to your tax work, you should be looking for individualized support. Firms that package tax work with controversy and audit support are trying to catch your eye, saying, “Look at everything we can offer you!” If the tax assessment they provide is strong, these packages are not necessary and you’re paying for something you shouldn’t need in the first place.

5. There Is a History (Often Public) of a Toxic Work Culture

Do not be afraid to Google the firm you are considering. If several articles pop up detailing sordid work environments that include sexual harassment; lawsuits against former clients and employees; and obviously fake Glassdoor reviews, you can assume the firm itself is a red flag.

6. Targeting of Less-Sophisticated Businesses as Clients

Be aware of firms that go after mid-market and below businesses that are less “sophisticated” than other potential clients. They will usually peddle less-than-legitimate sales tactics, like promising a Porsche or other luxury vehicle, as an incentive to lure these businesses into hiring them. Red flag firms know less refined companies will not catch on to these “scummy” offers because they do not have the experience to know any better.

7. They Employ a “Cut-and-Paste” Approach

Many tax credits, like the R&D tax credit, require year-by-year claims, and in order to qualify, your tax return must depict work calculated and substantiated independent of years past. If a firm utilizes the “cut-and-paste” approach from the year before, this indicates sloppy work — and a red flag indicating you should choose a tax provider willing to perform the work necessary year after year without cutting corners and risking an IRS audit.

Keys to Selecting a Reliable Tax Credits and Incentives Provider

Now that you know what to avoid, here are some things a tax provider should have in order to best assist you with tax credits:

1. They Are a Full-Service Accounting Firm.

A full-service accounting firm knows how to look at an organization holistically, providing the services necessary simply by peering beneath the hood. They will know how things work, and we are happy to tell you how to optimize — including how tax credits can be used or monetized within your business. Look for a firm that provides tax, audit, controversy, and more services, all under one roof.

2. They Prioritize the Security of Your Information.

A good tax provider knows your information is sacred and will treat it as such. While cybersecurity risks are never fully eliminated, stick with a firm with SOC or equivalent data protection. This way you are much less likely to have your sensitive financial information exposed in the event of a data breach.

3. They Employ Quality Control

Look for a firm that utilizes multiple levels of internal review, so you know that the work you are getting has been vetted and approved by a strong system of quality control — all with your best interests in mind. When you are dealing with something like tax credits, you cannot take the easy way out or cut corners, so finding a provider that maintains control strength is crucial.

4. They Never Make a Decision for You

While you want to trust your tax provider, at the end of the day, whatever decisions your organization makes regarding your tax credits affects you and only you. A reliable firm will not pressure you into questionable decisions. They will empower you through thorough education so you can feel confident making the right choice yourself.

5. They Charge You a Fixed Rate Based on Hours Worked

Unlike a red-flag firm, the firm you want to hire only charges a fixed rate based on the hours they work for you, rather than contingency-based charges taken from the recoup. This indicates they are focused on the outcome for you, not what that return means for them. A firm like MGO will perform an initial fact-find to determine eligibility and then make a conservative estimate, so you know exactly what to expect.

6. They Follow a Professional Approach

Professional means qualified, and a good firm provides services from specialists with real certifications and strong backgrounds in the industry. Look for a tax provider that regularly publishes news, articles, and thought leadership detailing emerging opportunities and risks. The team you hire is embarking on a journey with you — and to create opportunities, gain competitive advantages, and see your hard work culminate in rewards, you want to work with someone you can trust: someone proactive and well-informed.

Our Perspective on Ethics in Tax Credits and Incentives

Tax credits and incentives provide plenty of benefits you do not want to miss out on — and their often-complex application and qualification processes are reason enough to hire a tax provider to help you maximize your returns. However, it is important to be aware that not just any tax provider will do. Be aware of red flags and know what specifically to look for in a firm.

At MGO, our dedicated Tax Credits and Incentives team brings over 30 years of experience. We will take a holistic view of your operations and processes to identify areas where you may be able to claim tax credits and incentives.