As the COVID-19 pandemic continues to reshape economic and social realities across the globe, MGO leaders are examining specific industries to provide insight on emerging difficulties and future opportunities.

The novel coronavirus/COVID-19 is having a growing and dramatic impact on us personally and on the global economy. Throughout this article we will provide business leaders with a perspective on the evolving situation and implications for their technology companies.

On one end of the spectrum, we are faced with new and difficult economic challenges – how we pivot and overcome fear in the face of adversity will define who the future leaders in the technology industry will be. On the other end of the spectrum, new growth opportunities in the industry remind us all that when technology is used right, it makes what was once was impossible, possible.

“Remember that weaknesses don’t matter if you find solutions.”

-Ray Dalio

The novel coronavirus is affecting technology in a variety of ways, which makes the pandemic’s impact very difficult to monitor and evaluate. “The economic outlook is evolving on a daily basis,” observed Federal Reserve Chairman Jerome Powell. “And it really is depending heavily on the spread of the virus, and the measures taken to affect it, and how long that goes on. And that’s just not something that’s knowable.

Writing down a forecast in these circumstances is challenging at best, and would lack usability as a result of the uncertainties noted above.

Despite the current clouds, at this point certain conclusions seem obvious:

- Life has changed and change creates opportunities: At one end of the spectrum sits Amazon and its plan to hire 100,000 workers and implement an immediate $2.00-an-hour raise through April. Examples of other tech sectors on this end of the spectrum include cloud computing, cyber security, EdTech and telemedicine.

- Consumer fulfillment? Yes. Consumer touch? Not so much: At the other end of the spectrum sits countless high-tech conferences (including Facebook's F8 Developer Summit, Google’s I/O, Apple’s WWDC, and Microsoft Build to name a few) that have been postponed or moved to online-only. That’s likely a multimillion-dollar loss for the vendors and other companies that service these events. Similarly affected are in-person, consumer-focused tech sectors, such as payment processing and ridesharing, among others.

Impact of supply chain disruptions

At a macro level, the critical areas that are weighing heavily on the industry are production and supply chain management (mainly international), which have a direct financial impact on technology companies.

Production has been adversely affected by the virus’ effect on a main production source, China, and on other Asian countries that supply China. Consider electronics products: given that the concentration of products assembled in China is huge, significant problems are created for the entire tech industry, everything from semiconductors and printed circuit boards, to complete systems for consumer electronics, cars and industrial applications.

- A special Institute of Supply Management survey found COVID-19 kicked off supply chain disruptions for almost 75% of U.S. companies, with many of them now forecasting revenue declines for expected 2020 results. Additionally, of the companies expecting a negative impact, 80% expect the severity of the disruptions to accelerate beginning in the second quarter.

- Survey respondents, of which 81% are firms with revenues of less than $10 billion, cite a variety of developments that are impacting the supply chain, including the following estimates:

- Chinese manufacturers are operating at 50% of capacity

- 44% of companies taking part in the survey reported not having a plan in place to combat supply disruptions

- 62% of respondents say their deliveries from China are delayed

- 53% of respondents are having difficulty getting supply-chain information from China

- 48% are experiencing delays transporting goods within China

- TrendForce, a market research company, offers a dire forecast for first quarter global smartphone production: a 10% decline from expectations prior to the COVID-19 outbreak. Double-digit shipment declines also are forecast for smartwatches (-16 percent), notebooks (-12.3%), smart speakers (-12.1%) and video game consoles (-10.1%).

- In a recent survey aimed at determining the outbreak’s effect on supply chains, IPC International Inc., a trade association for the electronics manufacturing industry, found that – of 101 companies polled – 22 percent expect fewer new product introductions this year as a result of the COVID-19 outbreak.

- The study also found strong sentiments that COVID-19 will hurt worldwide enterprise and consumer IT spending. Thanks to significant government stimulus in the U.S., China, and elsewhere, some of the deferred spending is expected to return gradually in 2020’s second half.

- Tech sectors that touch (or are dependent upon) consumer spending also face difficult times. Uber Technologies Inc. and Lyft Inc. have already seen U.S. ridership plunge in March as Americans were ordered to stay at home.

Financial technology faces hardship

FinTech, with both B2C and B2B characteristics, sits somewhere in the middle of the overall tech industry.

Companies providing financial services – such as payments processing and lending to small companies, are experiencing a decline as those companies (especially retailers and eateries) close their doors temporarily and, in some cases, permanently.

PayPal Holdings Inc. (PYPL), which processes payments for 24 million online merchants, expects lower-than-forecast first quarter revenue because of less cross-border e-commerce activity. The company also has a $2.6 billion book of loans to small businesses and could face problems if borrowers start to miss payments or default entirely.

Square Inc. (SQ), a popular payment system, especially for small businesses, is being hit both by the drop-off in transaction volume and in its lending activities as well.

Opportunities for education technology and telecommunication

On the positive side, the widespread move to home-schooling and working from home has focused a spotlight on EdTech- and telecommuting-related companies, as well as companies providing office equipment, software, cloud computing, networking infrastructure and network security.

EdTech companies expected to get a boost include 2U, Inc., Chegg, Inc., Pluralsight, Inc., and K12, Inc. Among software companies that provide remote access and collaboration, Zoom, Slack, GoToMyPC, Zoho Remotely, Microsoft Office365 and Atlassian are forecast to outperform.

In the area of memory products, DRAM and NAND are not expected to be affected by the outbreak, as semiconductor fabrications are highly automated, with very low demands for manpower. These companies stocked up on materials before the Chinese New Year, so there shouldn’t be any short-term shortages.

Navigating a new reality

One certainty is that things will be different going forward. Optimists hope COVID-19 mimics the performances of SARS in 2002, the H1N1 influenza of 2009, and MERS in 2012. Come and gone more quickly than expected…permitting markets, economies and societies to bounce back rapidly. Pessimists, however, point to the longer duration and impact of HIV/AIDS.

The final impact is to be determined, of course, but it is clear that COVID-19 will leave an enormous impact on how we consume, how we learn, how we work and how we socialize and communicate.

Telecommuting

Telecommuting is here to stay – good news for many business enterprises that will benefit from lower staff and facility costs, and thereby higher profits. Makers of the applications facilitating telecommunication will also benefit greatly. Whereas smaller businesses that depend upon face-to-face interaction may face an uncertain future.

Online learning

Online education means larger class sizes, higher revenue per class and reduced operating costs at colleges and universities. It’s not a panacea for all types of learning, however; chemistry and biology labs and the arts being noteworthy examples.

Telemedicine

Until now, the idea of telemedicine was always a concept for the future. But, much like the way content will be consumed going forward, the way healthcare delivery occurs will also be disrupted. There are additional, cascading benefits as well: a video call keeps the patient out of the transit system, out of the waiting room and, most importantly, away from patients who need critical care.

Streaming

The jury is still out on movie theaters and live events. Streaming clearly will become an even more important way to deliver and consume content. Current streaming companies and those that pivot in this direction will benefit.

Internet infrastructure

Even with the unfortunate amounts of misinformation, the importance of the internet as a critical social, educational and communications solution has been evident from the start of the pandemic. Its importance will only grow in the future. Bandwidth will be a challenge, however, as certain parts of the country are served by an inferior infrastructure.

Supply chains

A huge percentage of U.S. companies are dependent on supply chains that have China as the priority provider. With China capacity halved, many U.S. companies don’t have a Plan B. It’s likely that popular products will be unavailable in coming months and companies are going to have to reconfigure supply chains going forward. This could cause some near- to mid-term dislocations.

What technology companies should focus on now

The Coronavirus pandemic will continue to affect profits and liquidity by increasing procurement expenses and capital costs while simultaneously forcing customers to defer purchases. In some cases, these consequences are already apparent. To protect tech companies’ businesses and to ensure they rebound as quickly as possible, tech companies will benefit from financial stress tests in which they examine their current cash flows and balance sheets. They can then determine how company finances might evolve if any of the scenarios defined by their stress tests materialize.

“Identify your problems, but give your power and energy to solutions.”

-Tony Robbins

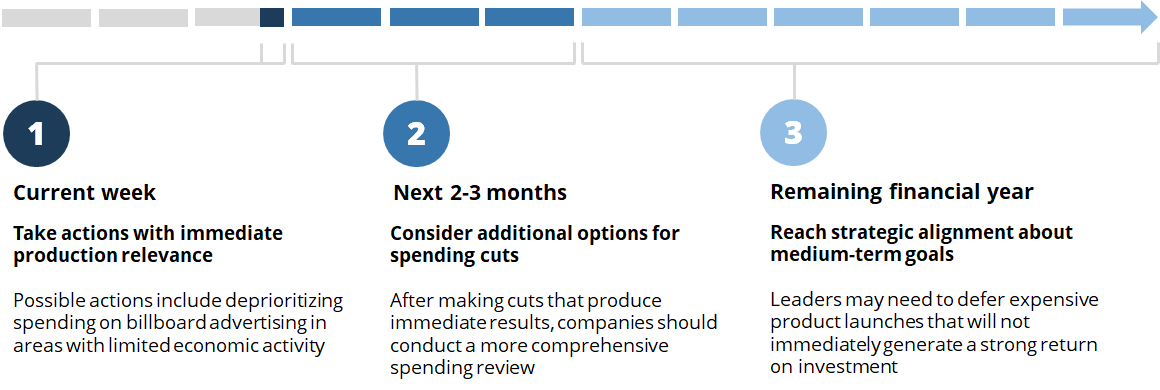

To protect the ecosystem, companies in technology industry could look beyond their walls by setting new spending priorities considering different time horizons:

The impact of Coronavirus will continue to be felt for months to come, but the technology industry companies can move quickly to protect their employees, customers, and other members of their ecosystem.

About the authors

Cesar Reynoso is Office Managing Partner of MGO’s San Francisco office; Eric Harrison is a Managing Director in the San Jose Office; Eugene Ma is an Assurance Partner in the San Francisco Office, and Ashley Best is a Financial Analyst in the San Francisco Office.