Key Takeaways:

- Regularly assess property values to find and appeal over-assessments, reducing manufacturing tax burdens.

- Leverage tax incentives and exemptions for manufacturing to lower property tax liabilities.

- Maintain accurate asset records and consult manufacturing tax professionals for effective tax management.

~

While manufacturing and distribution companies face many challenges, one significant area of concern is property taxes. These taxes can be a substantial expense, affecting overall profitability. If you are looking to improve the financial performance of your manufacturing company, implementing effective strategies to manage and reduce property tax burdens could be beneficial.

Here are eight key strategies to help your manufacturing business lower its property tax liabilities:

1. Conduct Regular Property Assessments

One of the most effective ways to manage property taxes is through regular reviews of your property tax statements. Your company should conduct detailed evaluations of the property values listed on its county property tax statements to make certain you are not being over-assessed on abandoned, sold, or underused properties. Assess whether your fixed assets software is robust enough to capture depreciable assets purchased, sold, abandoned, and fully depreciated but still in use. Are depreciable asset classes appropriately identified?

Engage with professional appraisers who specialize in industrial properties to get correct valuations. This process can find discrepancies and provide a basis for appealing inflated assessments. Schedule regular property reviews annually or biannually, depending on the additions and deletions to your business’s depreciation schedule. Periodically reassess your business real estate values based on the volatility of property values in your area.

It is also beneficial to understand the real property assessment methodology used by local authorities, as this can help in finding any systematic overvaluations or errors. Is it at market value, a percentage of fair market value, comparable properties values, or highest and best use?

2. Appeal Unfair Assessments

Be diligent in preparing your business property declaration. It will be the basis for your business assessment notice. If it appears inaccurate, filing a timely appeal can lead to significant tax savings — not only for the current year but, more importantly, for future years as well. Each district has its own separate procedures for real and personal property appeals, typically requiring substantial evidence to support claims of overvaluation. Compiling comprehensive documentation — including recent appraisals, comparable property values, and evidence of any property issues — can strengthen your case for a reduction.

The appeal process can be complex, often involving strict deadlines and specific forms. Consulting with an attorney or tax advisor with experience in property tax appeals can help you navigate this process. Keeping a detailed timeline and records of all communications with tax authorities can also be beneficial during the appeal.

3. Leverage Tax Incentives and Exemptions

Many state and local governments offer tax incentives, sales tax exemptions, and property tax abatements for certain industries and property types. Examples of such incentives include enterprise zone credits — which provide tax benefits for businesses working in economically distressed areas — and investment tax credits for the purchase of new machinery, equipment, and parts.

Additionally, some authorities offer pollution control exemptions for equipment that reduces environmental impact. Researching and applying for these and other tax credits and incentives can lead to significant tax savings.

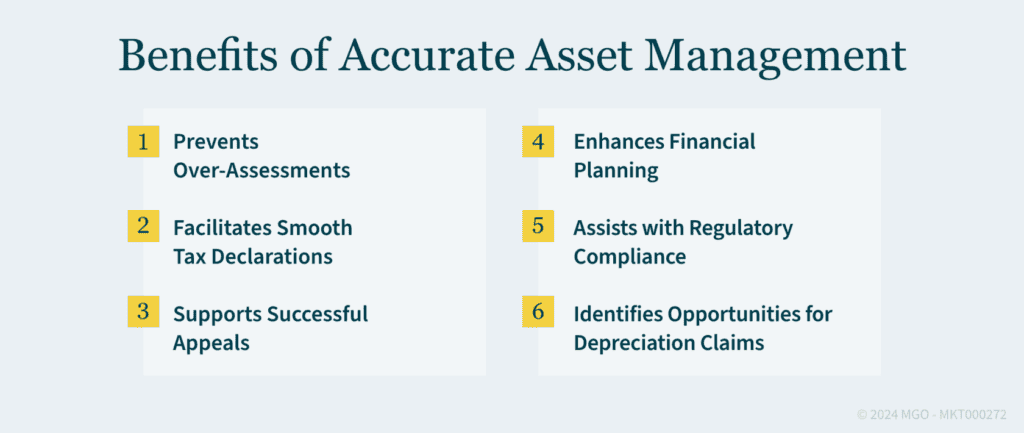

4. Keep Accurate Asset Records

Accurate and up-to-date asset records are crucial for effective property tax management. Document all machinery, equipment, and property improvements — noting purchase dates, costs, and any depreciation. These fixed asset records must be tied to the annual property tax filing declaration statements before assessment notices are issued. Correct and accurate declarations prevent over-assessments and can help you avoid appeals.

Adopting a comprehensive asset management system and utilizing an appropriate software package can simplify this process. These systems can check the lifecycle of each asset — including maintenance and upgrades — which can influence its value. Regular audits of these records can confirm that they are accurate and up to date, preventing discrepancies that could result in higher tax assessments.

5. Improve Property Use and Zoning

Reviewing and refining the use of your property can also lead to tax savings. Sometimes, reconfiguring the layout or usage of space can qualify for lower tax rates. Additionally, understanding zoning regulations and looking for rezoning where beneficial can result in lower tax obligations. Consulting with zoning professionals and local authorities can provide insights into potential savings.

For instance, converting unused or underutilized space into areas that qualify for lower tax rates — such as storage or non-commercial use — can reduce tax liabilities. Additionally, exploring opportunities for mixed-use zoning, which can offer tax benefits, might be worth considering.

6. Engage with Local Tax Authorities

Building a relationship with local tax authorities can be helpful. Regular communication and collaboration can lead to a better understanding of the tax landscape and potential changes that could affect assessments. Being proactive and transparent with local authorities can also help you negotiate favorable terms or resolve disputes amicably.

Attending local tax board meetings and staying informed about upcoming changes in tax regulations can give you a competitive edge. Providing a direct line of communication with key officials can facilitate smoother negotiations and quicker resolutions of any issues that may arise.

7. Invest in Tax-Effective Property Improvements

When planning property improvements, consider the tax implications. Investing in enhancements that qualify for tax credits or abatements can offset some of the costs. Additionally, improvements that increase energy efficiency and/or lighting use or sustainability may be eligible for specific incentives, further reducing your tax burden.

For example, installing solar panels or energy-efficient HVAC systems can qualify for green energy tax credits. Improvements that align with local or federal sustainability goals can also attract added incentives, making the first investment more cost-effective over time.

8. Work with Tax Professionals

Navigating the complexities of property taxes requires specialized knowledge. Working with tax professionals who understand the manufacturing sector can provide you with valuable guidance and support. Experienced tax advisors can assist you with assessments, appeals, incentive applications, and strategic planning — helping your company enhance its tax savings.

Tax professionals can also provide you with insights into industry-specific tax breaks and guide you through compliance with all relevant regulations. Regular professional consultations can help you anticipate, prepare for, and swiftly adapt to changes in tax laws, helping you sustain tax efficiency.

Reduce Your Property Tax Liabilities to Improve Your Financial Performance

Lowering real estate and depreciable property tax burdens in the manufacturing sector requires a proactive and strategic approach. Your company may be able to significantly reduce its tax liabilities by regularly reviewing property declarations, appealing aggressive valuations, and utilizing available incentives while maintaining updated records and optimizing property use. Additionally, engaging with local authorities, investing wisely in property improvements, and collaborating with tax professionals could further enhance your savings.

Implementing these strategies can not only improve your financial performance but also provide you a competitive edge in the market.

How MGO Can Help

Don’t let property taxes unnecessarily burden your manufacturing business. With extensive experience working with manufacturing and distribution companies, our tax professionals can help you get the most from your tax savings. Reach out to our team today to start optimizing your property tax management and improving your company’s financial performance.