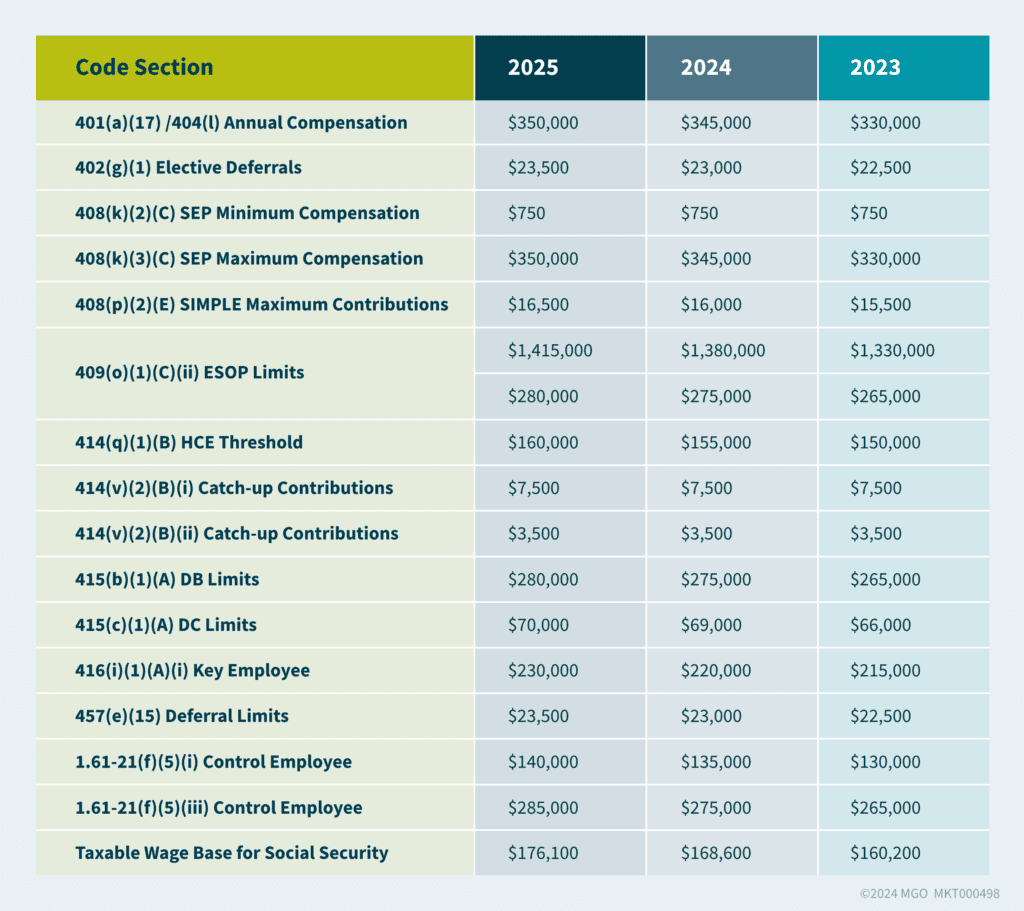

Key Takeaways:

- IRS raises 2025 limits, with 401(k) deferrals now $23,500.

- Catch-up contributions stay at $7,500 for those 50+ years old.

- Compensation caps rise, impacting benefit calculations.

—

MGO presents a highlights summary of the significant cost-of-living adjustments (COLA) effective for 2025. These adjustments — recently announced by the Internal Revenue Service (IRS) and the Social Security Administration (SSA) — have a wide-ranging impact, including the savings rate for retirement plans. All annual compensation amounts and limits for elective deferrals were increased, except for catch-up contribution limits. We will continue to provide updates on regulatory matters impacting retirement plans in the coming year.

MGO provides strategic guidance for retirement plan audits and compliance. Our professionals expertly navigate regulatory complexities, ensuring effective plan management and compliance. Stay informed and optimize your retirement plan limits by visiting MGO Employee Benefit Plan Audits.