Executive Summary:

- The GASB has launched their first initiative to establish and introduce guidelines for ESG-related disclosures.

- The GASB has released an interpretation of its existing standards to help government entities further enhance ESG-related disclosures.

- We can expect that ESG-related disclosures will shift from voluntary guidance to mandatory reporting at some point.

Reporting and disclosure of environmental, social, and governance (ESG)-related information has long been a priority in the private sector and is now emerging as a key area of focus for state and local governments (or “government entities”).

In response to interested parties seeking more ESG-related information (e.g., investors, credit rating agencies, preparers and auditors of financial statements, citizens, policymakers, etc.) from government entities, the Governmental Accounting Standards Board (GASB) has released a publication to clarify how ESG-related information intersects with their existing standards.

The bottom line: GASB’s stakeholders and interested parties are seeking to understand the impacts of ESG-related matters on a government entity’s cash flows, financial position, and overall responsibility for fiscal accountability — and the publication can be seen as a form of interpretive guidance to bridge the gap.

What’s inside the publication?

GASB’s “Intersection of Environmental, Social, and Governance Matters with Governmental Accounting Standards” document was released on May 31, 2022, and it provides clear examples for government entities to make new, or enhance existing, ESG-related disclosures by leveraging their current standards and principles.

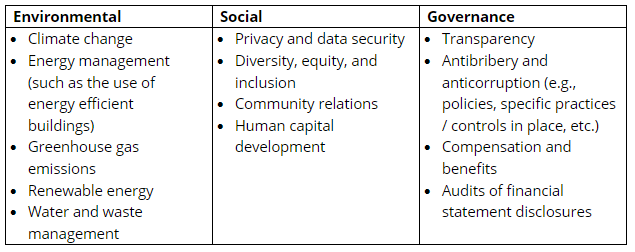

Up front, the publication acknowledges that “a single consistent definition of ESG is not prevalent in practice today.” However, broad examples are included in the publication for each pillar (note, the below list has been shortened for purposes of this article):

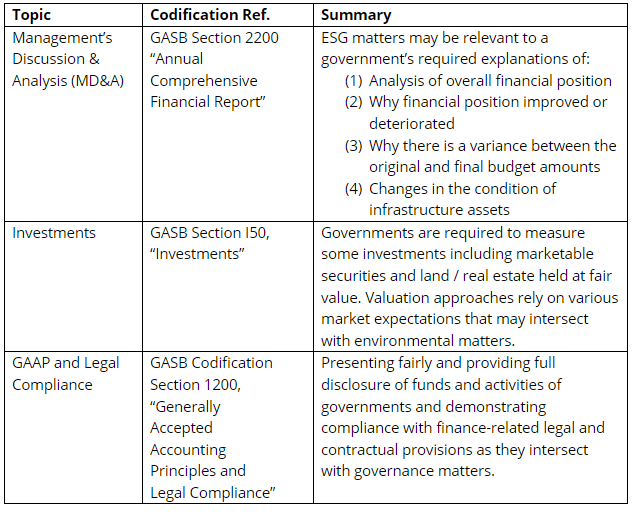

The interpretive portion of the publication goes on to assist government entities with detailed examples of how ESG-related information coincides with the current GASB standards (note, the below are 3 of 25 total examples from the publication):

Why this GASB release matters

In publishing this document, GASB is taking a traditional first step to introduce concepts and guidelines that set a foundation ahead for new reporting and disclosure rules in the future (also referred to as “interpretive guidance”).

This is not the first time a regulator or standard setter has issued interpretive guidance specific to ESG. In 2010, the Securities and Exchange Commission (SEC) released their own interpretive guidance to provide clarity to the private sector on how to leverage existing financial reports to make disclosures related to climate change. While it was uncertain how many companies would incorporate climate-related information in their financial reports, many chose to do so (at last count by the SEC in 2020, 33% of the 6,644 filings submitted to the regulator contained some form of climate-related disclosure). The interpretive guidance, therefore, laid the groundwork for a new climate-related proposal issued by the SEC in March 2022.

Essentially, interpretive guidance has historically preceded the release of new, formal guidance and the creation of new standards. If this proves true in the public sector, then we will first see an increase from state and local governments enhancing their existing financial reports and disclosures by incorporating ESG-related information. Subsequently, and after further analysis by GASB of those enhanced disclosures, we will likely see the release of a new ESG-specific standard from GASB.

Increasing the pressure

As demand for ESG-related disclosures increases, pressure will also increase on governments to begin providing or enhancing the disclosures in their financial reports. Further, if your entity issues securities (e.g., municipal bonds), you may encounter pressure from credit rating agencies depending on your approach (or lack thereof) to disclose and address ESG-related risks.

At present, ESG-related disclosures are contingent on a variety of factors (including but not limited to the government entity’s location, the historical or anticipated impacts of climate change, the level of ambition to become a leader in ESG-related reporting, etc.), but at some point these disclosures will shift from voluntary to mandatory.

How MGO can help

Many state and local governments have proactively disclosed ESG-related information on their websites or in standalone ESG / sustainability reports; however, GASB’s interpretive guidance demonstrates that ESG-information also needs to be considered when preparing your annual financial reports.

To stay ahead, MGO is helping the public sector as well as the private sector, develop and enhance their ESG disclosure strategies.

If you are interested in learning more, schedule a conversation with our ESG team today.