Welcome to the Cannabis M&A Field Guide from MGO. In this series, our practice leaders and service providers provide guidance for navigating M&A deals in this new phase of the quickly expanding industries of cannabis, hemp, and related products and services. Reporting from the front-lines, our team members are structuring deals, implementing best practices, and magnifying synergies to protect investments and accrete value during post-deal integration. Our guidance on market realities takes into consideration sound accounting principles and financial responsibility to help operators and investors navigate the M&A process, facilitate successful transactions, and maximize value.

The due diligence process is one of the most important stages of an M&A transaction. Carefully verifying the financial and operational information provided by the Target company helps ensure the quality and fairness of the deal and reduces the risk of inheriting liabilities that could put the Acquirer at risk. The resources and effort invested in due diligence act as a form of insurance against surprises following the transaction.

The financial and regulatory complexities inherent to the cannabis and hemp industries make the due diligence process particularly important. There is tremendous risk in not knowing the full details of the Target company’s tax liabilities, contract obligations, intellectual property issues, licensing terms, litigation risks, and overall operational processes.

Every due diligence process will be unique to the involved parties. In the following sections we will lay out the fundamental steps and provide guidance for potential issues and opportunities unique to the cannabis and hemp industries.

What does M&A due diligence involve?

Due diligence is an in-depth investigation into a Target company’s financial, operational, and strategic initiatives. It is the act of looking at key issues of the business, including profits, financial risks, legal issues, and examining historical records and future projects. The process not only reviews financials and projections, but must also provide an accurate view of the Target company’s business model, including operational details, strength of internal controls, customer relationships, vendor contracts and relationships, skill-levels of current employees, and competitive status within the market.

Benefits to a robust due diligence process include:

- Improved negotiation process — Performing due diligence can facilitate better negotiation of the terms of the deal, including those pertaining working capital targets and definitions, net debt definitions, and optimal allocations of tax benefits.

- Risk analysis — Due diligence may uncover exposures to liability due to faulty products, regulatory compliance, tax exposures, environmental concerns, and other issues that can escalate to the point that the Acquirer’s operation may be at risk.

- Inherent bias — Both Acquirers and Target companies can be either intentionally or unintentionally biased. Due diligence puts analysis and confirmation behind core concepts, including integration potential or projections of sales and profits.

- Inability to seek restitution — It is essential to uncover any issues/liabilities before a transaction is complete, as opportunities for restitution are limited after a deal is closed.

If an Acquirer is entering the due diligence process, it has already completed some analysis of the risks and rewards. Too often, Acquirers approach due diligence as a high-level analysis limited to a search for red flags and fatal flaws. While this is an appropriate starting point, a comprehensive approach includes more detailed analysis of the target’s information, industry, and economic prospects.

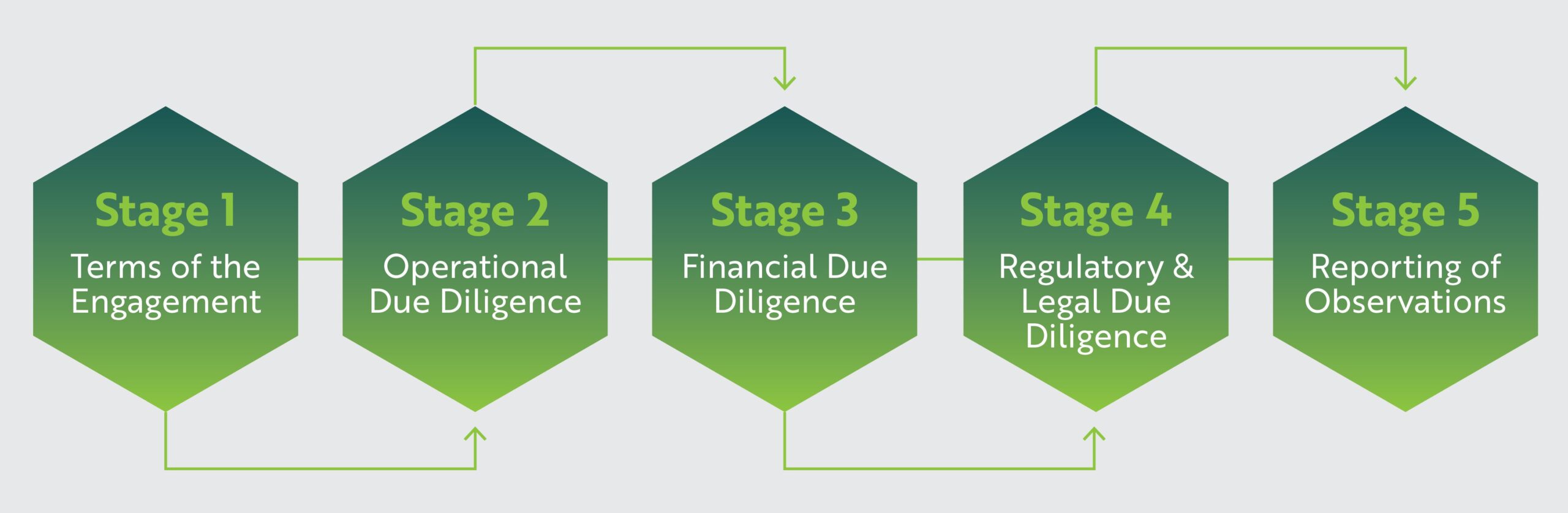

Overview of key stages of the due diligence process

Stage 1: terms of the engagement

Terms of the engagement are discussed and agreed-upon by both parties, this will include a list of all financial information, contracts, licenses, and other documentation to be provided by the Target company. A non-disclosure agreement is signed, after which the review process may commence.

Stage 2: operational due diligence

Operational data and documentation is gathered and provided to the Acquirer’s due diligence team, typically via a data room. The Acquirer’s team then reviews and analyzes the data. This stage should also include on-site reviews of assets/property within the purview of the engagement.

The key here is to understand the effectiveness of the Target company’s operating model. This should include a market analysis that looks outside the Target to identify competitive advantages, market specifics, and the investments necessary to scale operations.

Stage 3: financial due diligence

All relevant audited financial statements, tax documents, records, and projections are reviewed. Emphasis here is on confirming both past performance and the viability of future projections. The process should also include interviews with the Target company’s financial management team and external auditors.

Findings in this stage will provide important information on tax and debt exposures and capital expenditures, while also informing post-transaction net working capital needs.

Stage 4: regulatory/legal due diligence

This stage is focused on identifying any legal exposures or risks, with special focus on the status of licensing and regulatory compliance. This will include a review of licenses, leases, purchases agreements, regulatory reviews and all contracts. Of particularly focus here is the documentation of regulatory reviews and compliance.

Stage 5: reporting of observations

After the review processes are complete, the Acquirer and Target company will meet to discuss the results of the review and the Acquirer will have the opportunity to ask follow-up questions and request more information/documentation.

Specific areas of due diligence for the cannabis and hemp industries

Every industry has unique operating models, financial structures, and legal considerations that must be taken into account when conducting due diligence. In the following we will address some key points that should be examined for transactions in the cannabis and hemp industries.

Enhanced regulatory compliance

The validity of licenses and a company’s ability to meet and maintain regulatory compliance is of the utmost importance when considering an M&A deal in cannabis and hemp. Just because a company is operating, it does not mean it is doing so legally.

There are multiple layers of compliance necessary for operation: including State, Local and Federal. Maintaining compliance with one does not mean the other conditions are met. Diligence relating to state and local law compliance must be tailored to the legal and regulatory specifics of the states and localities where the Target company operates.

Quality of financial documentation

A roadblock encountered in many cannabis transactions can be traced back to an overall lack of accuracy and detail for financial statements and reports. Many smaller cannabis operations simply do not have the back-office resources to produce documentation in accordance with accounting principles and standards.

These circumstances do not necessarily represent an effort to obfuscate or mislead – but all precautions should be taken to avoid potential misrepresentations of transactions. In instances of poor financial documentation, the responsibility of securing and analyzing appropriate documentation falls on the Acquirer.

Contract review

Due to the often times unclear legality of cannabis enterprises, all business relationships demand extensive scrutiny in the cannabis context. These include property leases, vendor and supplier contracts, and insurance policies. Any standard-issue contracts and agreements, which do not explicitly acknowledge and conform to the legality of cannabis operations, often require follow-on agreements.

Ownership transparency

Many cannabis operations have complex corporate structures comprised of affiliates and subsidiaries, especially in the case of multi-state operators. Ownership and control are typically directly tied to the licensing arrangement of a cannabis operation. It is important to conduct diligence to confirm the ownership formation provided by the Target is both accurate, and that the transfer of licenses will not be negated by a change of control.

For example, if a license is issued under “Social Equity” guidelines, those conditions may not apply to the new ownership group, which can cause a variety of post-transaction issues.

Banking and insurance relationships

The fraught legal status of cannabis at the federal level has made access to banking and insurance extremely difficult. When reviewing these relationships, it is important to ascertain that financial services and insurance providers are fully aware of the business conducted by the Target company and the contracts and coverage are appropriate.

Oftentimes, financial institutions and insurance providers will have conducted their own regulatory diligence before entering a relationship with a cannabis company, and their input/assistance can provide valuable insight during your own diligence procedures.

Tax exposure

With the cannabis industry continuing to exist in a legal gray area at the federal level, tax issues are of the utmost importance. Some cannabis operations take a “creative” approach to managing tax exposure, specifically in regards to 280E. When examining financial statements it is important to identify the accounting methods used and confirm whether they are appropriate. All too often cannabis operations are audited and found to be short in tax payments to the tune of millions of dollars. As the Acquirer you do not want to inherit this kind of liability.

Final thoughts: do the homework

Developing and implementing a thorough due diligence process before acquiring a business is simply smart business. While due diligence will not necessarily make a transaction successful, it can help reveal potential threats and risks, and support informed pricing, valuations, or other adjustments later in the transaction process. An extra benefit comes from the ways the information gained during due diligence, especially related to operational specifics and corporate culture, can ease the transition and drive efficiencies during post-transaction integration process.

Catch up on previous articles in this series and see what's coming next...