Welcome to the Cannabis M&A Field Guide from MGO. In this series, our practice leaders and service providers provide guidance for navigating M&A deals in this new phase of the quickly expanding industries of cannabis, hemp, and related products and services. Reporting from the front-lines, our team members are structuring deals, implementing best practices, and magnifying synergies to protect investments and accrete value during post-deal integration. Our guidance on market realities takes into consideration sound accounting principles and financial responsibility to help operators and investors navigate the M&A process, facilitate successful transactions, and maximize value.

Assessing the value of a cannabis/hemp operation will ultimately be the foundation of any M&A deal. The Acquirer will seek the lowest “fair” price for the Target company and its assets, whereas the Target company will value itself at the highest possible price. The truth will fall somewhere in between and it is of central importance that both parties feel that risks are acknowledged, and that the value brought to the table is recognized.

In most cases, a third-party valuation expert will be brought in to conduct an impartial assessment. To recognize the true value of an operation, it is essential that this valuator is not only an expert in the cannabis and/or hemp industries, but also specializes in the appropriate verticals. For example, when assessing a cultivation facility, the valuator must have the skill to go beyond standard benchmarks, like yield/sq. ft. and grams/watt, and be able to interview the head of cultivation, understand the specialized skills they are bringing (or lacking) and also assess intangibles like the value of unique cultivars. Similarly for a retailer, revenue and expenses provide a baseline, but a valuator must also understand nuances, like the socio-economic details of operating markets and consumer attitudes to proprietary brands.

Valuation in any industry is a complex process, but like all things cannabis and hemp, shifting regulatory and market conditions present another layer of complexity that limit the use of traditional metrics and values. This makes cannabis and hemp valuations as much art as science. In the following, we will lay out the quantifiable fundamentals behind a valuation and provide some key considerations for intangible aspects that lift (or depress) the real value of an operation.

Key factors in valuing a cannabis business

Regulatory Compliance – Every legally-operating cannabis or hemp business in the U.S. is necessarily licensed and compliant with state and local regulations. Since every market is unique and presents different challenges and opportunities, it is essential to both understand those rules and confirm that a Target company has the proper operations and internal controls in place to maintain compliance. In the best case scenario, the failure to maintain compliance will result in fines, penalties and temporary cessation of operations. In the worst case scenario, the entire operation can be permanently shut down.

License Terms, Supply and Demand – The broader conditions driving regulatory compliance are the structure and supply of licenses. In many jurisdictions, including California, many operators are working under temporary licenses, as approval processes for permanent licenses have been delayed. Temporary licenses are tenuous and provide no guarantees that a permanent license will follow. The value of an operation is largely dependent upon the ability to operate legally – excepting some cases of asset sales – making it essential to understand the specifics of how each license was attained and all relevant terms and conditions.

In general, when access to licenses is limited, those licenses are worth more. Many markets, whether at the state or local level, have strict caps on issuing licenses. In states with well-established markets, licenses have been issued for years, leading to an oversupply that can lower both cannabis prices and business valuations. It is also important to consider that states and localities can change their licensing procedures, which could potentially upend the market with new licenses or drive up value by limiting new issuances.

Management Team – Depending on the structure of an M&A deal, and post-integration plans, the skills and experience of the management team of the Target company can help determine a business’s value. The Target company’s leadership will have played a key role in achieving current performance, and will provide projected revenue and long-term strategic plans. Ambitious strategic plans are rarely worth the paper they are written on if the leadership team does not have potential to achieve them. Taking stock of the collective history of the Target company’s leadership will help put projections into perspective.

Even an M&A deal is focused on acquiring assets or integrating Target company operations without keeping senior management, the experience of the team that built the Target company will provide another metric for the viability of existing operational and financial processes and controls.

Operator categories and considerations

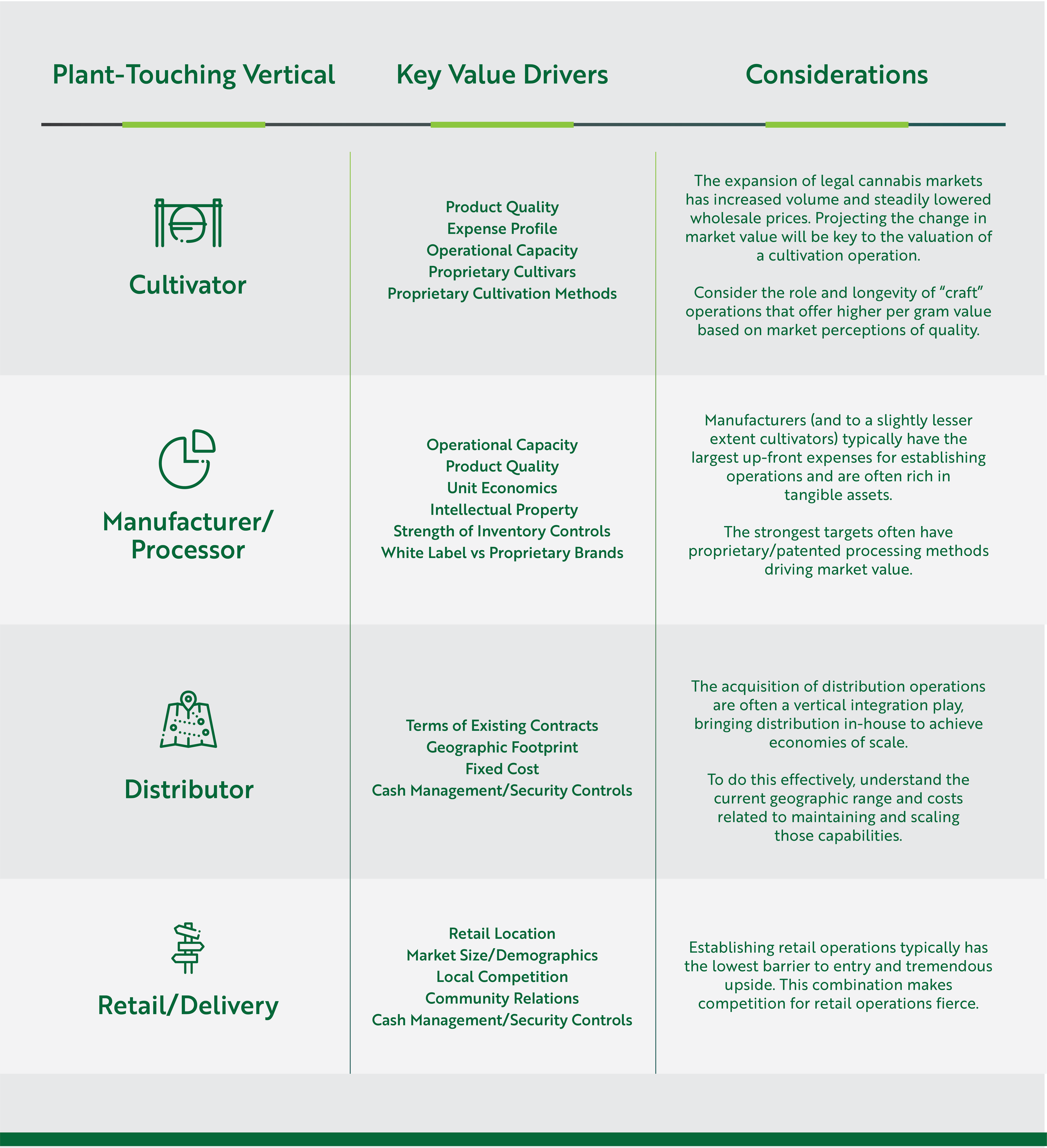

In the many verticals of cannabis, businesses fall into one of two broad categories: plant-touching, which are directly involved in cultivating, processing, or selling cannabis, and ancillary, which provide products and services to support the cannabis industry. Going beyond standard financial and operational metrics, each vertical has unique circumstances and considerations that will play a role in valuing the business.

Vertical integration is a key value driver across all plant-touching operations. Having a stake in more than one vertical provides control over product quality and supply, increases margins, and multiplies company value when executed correctly.

Commonly used methods for performing valuations

The following are four commonly used methods to assess value in the cannabis and hemp industries. The appropriate valuation method(s) depends on the company being valued, and will likely include a combination of approaches.

Discounted Cash Flow Analysis (DCF) - DCF measures the value of a company as the present value of all future projected cash flows. The DCF method is dependent upon multi-year projections of future cash flows, adjusted by an appropriate discount rate.

Strengths: Theoretically, if all assumptions hold true, DCF is the most accurate method for valuing a company as it provides an intrinsic valuation. This method allows the appraiser to adjust the financial forecast for different operating outcomes and assumptions to analyze the impact of various scenarios.

Weaknesses: DCF requires making assumptions about future performance and risk profile – and the valuation is only as good as the accuracy of those assumptions. The complexity of the cannabis market makes identifying realistic assumptions difficult.

Precedent Transactions Analysis - Building on the business adage of “something is worth what someone will pay for it,” Precedent Transactions Analysis analyzes the valuation metrics of similar businesses or assets that have been sold or have raised capital. The most common valuation metrics utilized are Enterprise Value / Revenue and Enterprise Value / EBITDA. By examining comparable transactions, an approximate value can be determined by adjusting for company size, growth, and other factors giving a relative valuation range.

Strengths: Based on actual valuations achieved by companies in the market, the Precedent Transactions Analysis can be an accurate gauge of the market’s perspective on value.

Weaknesses: There are a multitude of intangible qualities that ultimately determine value, including changes in leadership and shifting market conditions, the latter of which is completely outside the control of a business. There is limited amounts of data for cannabis/hemp industry transactions, and broader economic and social changes have essentially thrown out the comparisons used in previous years.

Public Comparable Company Analysis – This method values a company by analyzing the valuation metrics of comparable publically-traded companies. Similar to the Precedent Transactions Analysis, adjustments must be made to account for differences between the subject company and the comparable companies.

Strengths: The price of publically-traded companies are based on up-to-date market data and easily accessible. Additionally, quarterly earnings reports and other investor reports can provide detailed financial and operational information.

Weaknesses: This method is more useful in well-established industries with a multitude of comparable companies. Additionally, public company valuations are volatile and can swing heavily due to market factors independent of the company’s fundamentals.

Adjusted Net Asset Approach - The is approach values a company based on the fair market value of its assets less its liabilities. Assets include tangible assets, such as equipment, licenses, and staff, as well as intangible assets such as brand name and a loyal customer base.

Strengths: This approach establishes a fundamental baseline of value based on the company’s owned assets. If the company goes bankrupt, investors can hopefully at least recover the fair market value of these assets.

Weaknesses: As this approach does not consider a company’s income-generating potential, which is significant for most cannabis companies. This approach is generally reserved for distressed and capital-intensive companies.

Everything begins with thorough due diligence

Valuing any business first requires performing in-depth due diligence to understand the inner workings of the company. This includes analyzing the company’s products and services, operations, management team, market, competition, corporate governance, and more. Underlying each of these analyses is the on-going assessment of the company’s risks.

Companies should provide financial projections detailing their projected Income Statement and Cash Flow Statement for the next several years. Projections should utilize assumptions, which management can justify, and should be supported through thorough due diligence efforts. Recent events have shown that financial projections must be analyzed carefully as many are based on assumptions that no longer hold true – making achieving those projections impossible.

We provide more detail about the due diligence process in our dedicated article (COMING SOON).

Every valuation represents a unique case

Valuing a cannabis business is a complex process that is generally done on a case-by-case basis. There is no one answer to the best way to value a business. Landing on an accurate valuation requires in-depth due diligence to analyze the quantitative and qualitative factors driving the company. Ultimately, meetings with the leadership team and visiting the company’s facilities to see the business in action will speak volumes about underlying operational strength and long-term potential.

Catch up on previous articles in this series and see what's coming next...