Balancing international value and risk

Transfer Pricing

We can help you build and document transfer pricing policies that are detailed, practical, fully integrated with overall financial operations and tax plans – and adaptable to allow for growth.

Our transfer pricing services include:

- Transfer pricing planning and structuring

- Transfer pricing tools, analytics and operations

- Transfer pricing benchmarking

- Intangible Property (IP) and business valuation

- Transfer pricing compliance documentation

- Controversy support: Audit, Fastrak, APA, Competent Authority, MAP

- Uncertain tax provisions: FIN48, ASC 740

Bring value home with global tax support

Inbound Corporate Tax

For foreign entities entering the U.S. market we help coordinate business activities by establishing and optimizing import/export deals, avoiding a U.S. taxable presence, or creating an entity. We also support inter-company transactions through collaboration with our Transfer Pricing practice.

Outbound Corporate Tax

We help public and private U.S. entities entering foreign markets. Services we provide include:

- Coordination with foreign offices/affiliates

- Foreign tax credit (FTC) planning

- Anti-deferral regime avoidance

- Controlled Foreign Corporation (CFC)

- Subpart F Income Minimization

- Global Intangible Low-Taxed Income (GILTI)

- Passive Foreign Investment Company (PFIC)

- Earnings and profits (E&P) and dual consolidated loss (DCL) accounting

Flow Thru/Private Equity Tax Services

Whether an inbound or outbound entity, we assist private equity, venture capitalists, asset managers, and other investment groups explore and enter global markets. In addition, we help foreign flow through entities invest in U.S. businesses and capital markets.

U.S. Global Employer Services

We assist employers in sending employees abroad (expats) or having foreign employees enter the U.S. (impats). Our services include developing global compensation plans, including pensions, deferred compensation, and stock options; and hypothetical tax computation (hypo-tax) to confirm employers and employees are taking full advantage of totalization agreements.

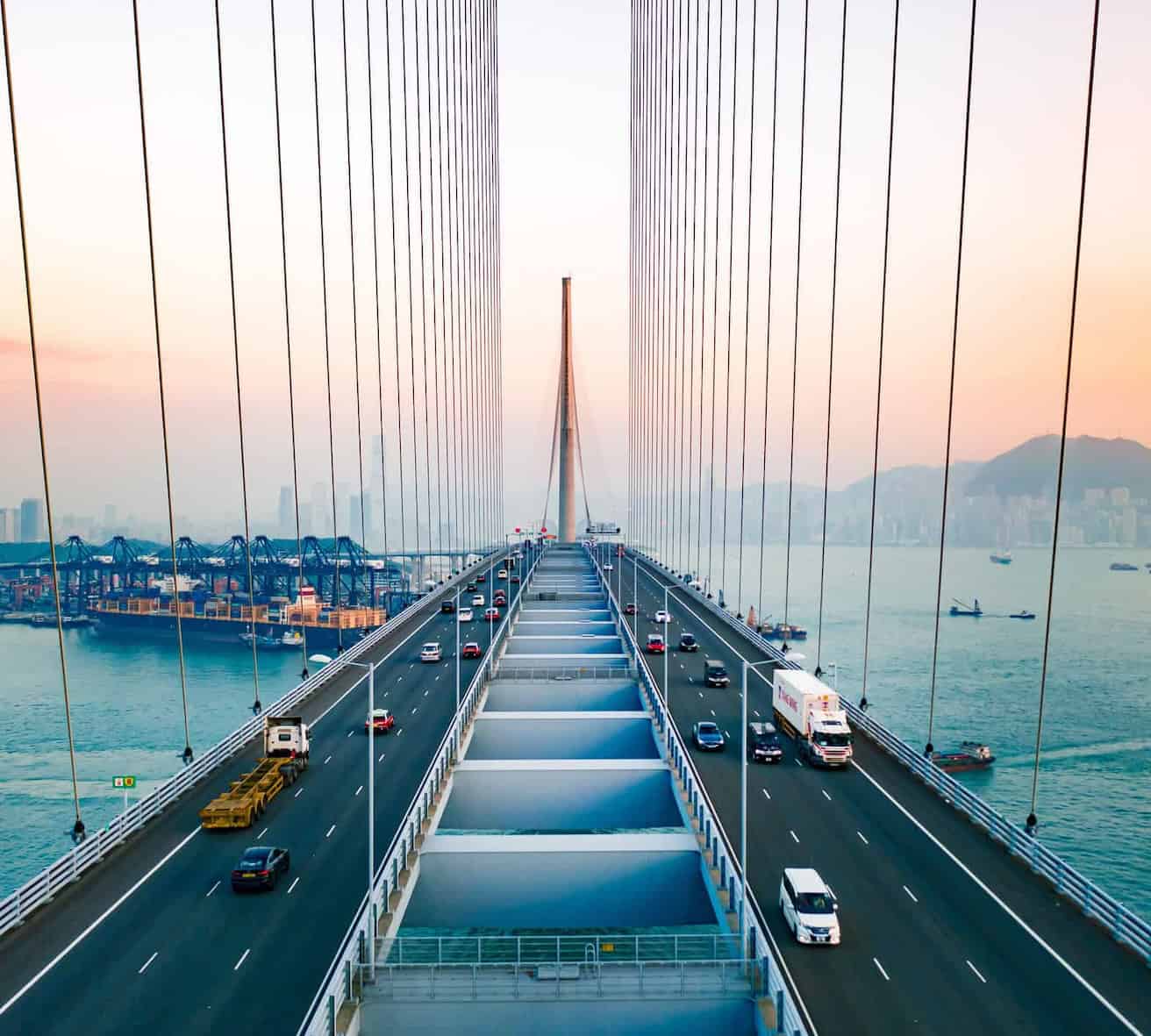

Supply Chain Management

Our phased approach helps public and private multinationals achieve a tax-efficient supply chain. Services are customizable to each level of a company’s life cycle and are performed in conjunction with our Transfer Pricing practice to confirm functions and profit allocations are appropriate.

International Tax Controversy

We assist taxpayers with international tax audits as well as submission to IRS programs, such as the streamlined filing compliance procedures, Delinquent International Information Return Submission Procedures (DIIRSP), handling specified procedures for waiver requests and delinquent IRS Form 1120-F, and other IRS matters.

Indirect Taxes

Consulting services involve assisting clients with value added taxes (VAT), Goods & Services Taxes (GST/HST/PST), and U.S. customs and duties. We also coordinate with a foreign office – whether an MGO affiliate, foreign law firm, or foreign accounting firm. Our compliance support focuses on assisting clients with foreign compliance calendars.

Foreign Tax Compliance

Consulting support includes OECD Pillar Two modeling for clients and assistance with planning for minimization of worldwide taxation. These services strictly involve income or direct taxes. Our compliance services focus on assisting clients with foreign compliance calendars.

Private Client International Tax

Through our Private Client Services offering, you can close the gap between yourself and cross-border activities. Whether you’re a U.S. citizen with foreign assets or a foreign individual with U.S. assets, our approach includes income tax minimization and transfer tax minimization techniques.

Other International Tax Matters

We provide a wide range of industries with guidance for specific nuances in international tax, including tax-exempt entities, entities operating in the cannabis space, as well as reviewing OECD matters and their implications.

Our promise to you

Limit your global tax rate

Every transaction, whether in-bound or out-bound, creates tax exposure. We’ll help you manage that risk and bring home more profits.

We speak business

With shifting tax laws in every jurisdiction, we have the resources to dive into the details and help you enhance the value of global investments.

Avoid double taxation

We’ll help you design and implement an effective and defensible transfer pricing policy that saves you time and money.

Take a proactive approach against IRS issues

Transfer Pricing Mock Audit

Take a proactive stance against potential IRS issues with our transfer pricing mock audit service, IRS Pre CheckUP. Our team conducts a thorough review of your current methodologies, assesses compliance with relevant regulations, and provides a detailed heat map of potential risks. We offer specific recommendations to address problem areas and assist with implementation to help your company be fully prepared in the event of an IRS audit. If you are concerned about exposure, get your IRS Pre CheckUP today.

Our Perspective, Your Benefit

Tax leaders ready to serve you

As you grow, you face complex risks and opportunities. Benefit from hands-on guidance focused on delivering top-to-bottom value for you and your organization.

Related Solutions

Enterprise Business Tax

Your goal is to drive growth on a large scale. Our goal is to identify strategic opportunities, streamline complexities, and deliver tax solutions that align with your enterprise’s needs.

State and Local Tax

With varying regulations in every market, reduce exposure and maximize your opportunities to save.

Tax Credits and Incentives

Put your profits back where they belong: driving expansion and innovation for your organization. With experienced guidance credits and incentives can be a powerful tool for fueling your growth.