Executive Summary:

- Agents and managers can help globally earning clients like professional athletes, musical artists, and entertainers strategically manage finances and taxes across borders to maximize earnings.

- For U.S. citizens and residents earning money abroad, key areas for advisors to address include endorsement deals, royalties, foreign properties, foreign tax returns, and tax structuring that considers foreign investments.

- For foreign (non-resident) athletes, artists, and entertainers performing in the U.S., considerations include but are not limited to U.S. taxable income, withholding rules, tax status, Central Withholding Agreements (CWA), and tax treaties.

~

As an agent or manager for athletes, artists, and entertainers, many of your clients likely earn income across borders as they perform worldwide. Strategically managing their finances and taxes is crucial to maximize earnings. Proper planning can help reduce tax burdens and avoid double taxation across jurisdictions. This allows your clients to focus on their careers while you may finesse your assistance to them in optimizing their income with guidance from tax professionals.

Understanding key tax considerations can enable you to put frameworks in place to mitigate your clients’ liabilities. For clients who are citizens or residents of the United States earning money abroad, all worldwide income must be reported to the IRS. However, foreign countries also tax income earned by non-residents. Assessing relevant tax treaties and structuring contracts in an appropriate manner can lead to more advantageous tax treatment.

When your clients have income from various sources both from inside and outside the United States, proactive tax planning is key. Common international income types to consider include:

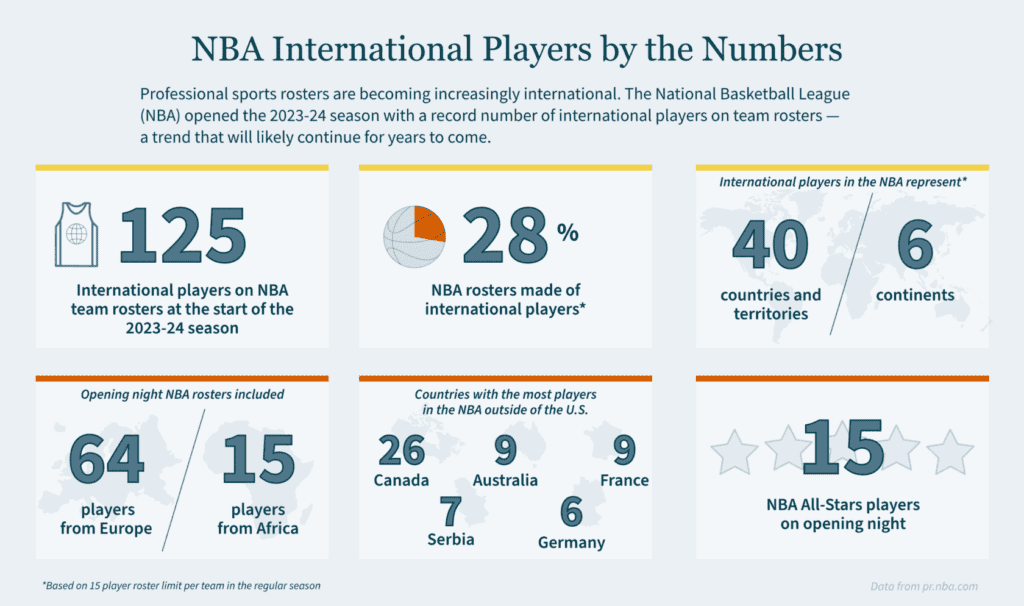

- Salaries from foreign leagues and tournaments

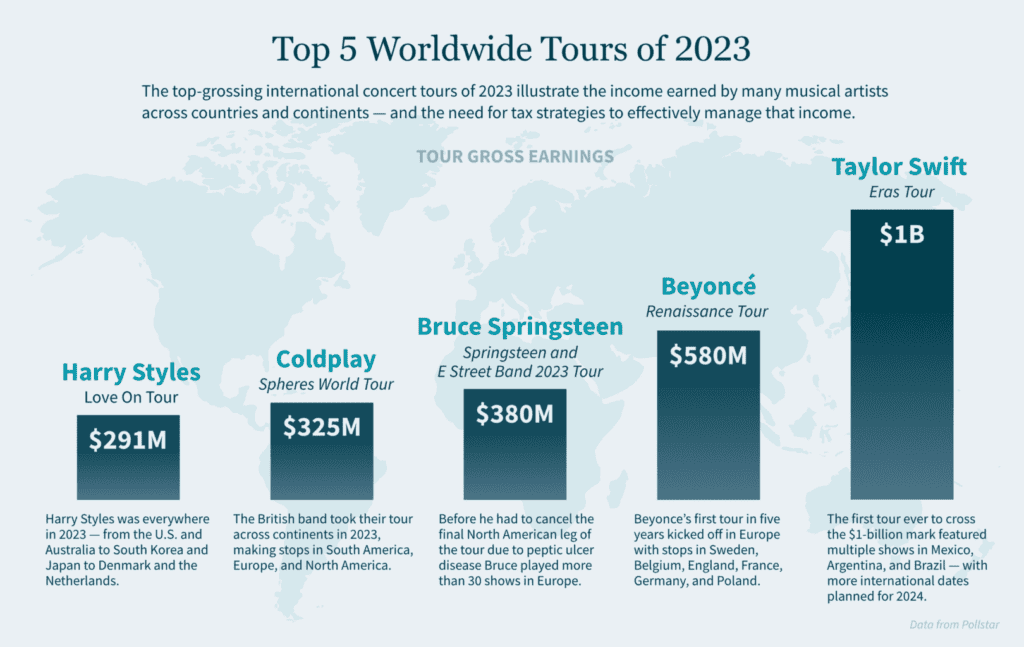

- Performance fees from concerts and festivals

- Royalties

- Endorsements and sponsorships

- Bonuses and prizes from international tournaments

- Merchandise sales

- Other income earned while playing or performing overseas

How these income types are classified and sourced impacts tax liabilities. Consulting tax professionals before your clients sign any deals allows for upfront planning that can keep more money in your clients’ pockets.

5 Key Considerations for U.S.-Based Athletes, Artists, and Entertainers Earning Income Abroad

If you are an advisor to musical artists, professional athletes, film actors, or other performers who are U.S. citizens, residents, or green card holders with foreign income sources, here are five important areas to address:

- Endorsement Deals – How will the construction of a contract impact tax treatment abroad? Will the income be considered U.S. or foreign sourced? What are some ways to proactively plan for potential tax savings?

- Royalties – Can royalties be classified differently if content is published while clients are abroad? How are royalties affected by collaborations with international artists? Is it considered U.S. income if royalties are received while playing or performing abroad?

- Foreign Properties – What are the tax rules surrounding your clients purchasing or renting homes abroad (rules may vary by country)? Did you know that foreign rental income may need to be disclosed on a U.S. tax return? How do investments in foreign countries get reported and taxed?

- Foreign Tax Returns – When is return filing required for extended stays abroad? Can foreign taxes be credited (and is the credit dollar-for-dollar)? What should be expected for payments received as a contractor versus as an employee? Which expenses are deductible in each country? For example, are agent fees, travel expenses, and entertainment deductible?

- Foreign Tax Structuring – Is it better to withhold taxes on gross revenues or after deductible expenses? How do local, state, and regional (provincial, cantonal, district, county) taxes factor in?

With these areas addressed upfront, you can maximize income and minimize overall tax burdens for your clients as opportunities arise.

5 Top Considerations for Foreign Domiciled Athletes, Artists, and Entertainers Performing or Playing in the U.S.

If you are an advisor to athlete, artist, and entertainer clients who are not residents or citizens of the U.S. but earn income in this country, areas that could have an impact on your clients’ taxes include (but are not limited to):

- U.S. Taxable Income – Is U.S.-sourced income taxable? What types of income may this include? Is there a requirement to file a U.S. federal income tax return? Is there an income threshold that must be met?

- Withholding Rules – What are the withholding rules surrounding payments to foreign athletes, artists, and entertainers?

- U.S. Tax Status – How is U.S. tax status determined — residency for income tax and domicile for transfer tax? How is taxation affected with or without a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN)?

- Central Withholding Agreements (CWAs) – A CWA is a tool that can help entertainers and athletes who don’t live in the U.S. by having U.S. income tax withheld based on the non-resident’s income. Is a CWA beneficial for the individual’s situation?

- Tax Treaties – Does the individual’s home country have a tax treaty with the U.S.? How does it impact tax liabilities?

Evaluating options surrounding tax statuses, withholding approaches, and applicable treaties can mitigate liabilities and optimize tax treatment for your foreign clients.

Work with Tax Professionals to Help Your Clients Maximize Global Income

As an agent or manager navigating global income for your clients, working with experienced tax professionals is key. Advisors can assess your clients’ situations across jurisdictions to put frameworks in place reducing liabilities and avoiding double taxation. With the right global tax strategy tailored to each client, you can position them to pursue worldwide career opportunities with maximum income and minimum taxes.

Need help navigating the world of international tax for athletes, artists, and entertainers? We have experienced professionals dedicated to both international tax and entertainment, sports, and media (ESM) ready to answer all your questions. Reach out to our International Tax Team today.