Executive summary

- Companies face tax burden challenges related the classification of cannabis as a Schedule I controlled substance and IRC 280E.

- To navigate this, companies may be able to utilize vertical integration strategies and incorporate transfer pricing best practices to minimize tax exposure.

- A transfer pricing study will help identify and risks or opportunities for improvement.

As the cannabis market continues to grow, in the United States cannabis operators continue to face difficulties related to an excessive tax burden due to IRC 280E. One of the most effective strategies for mitigating tax exposure under 280E has been to leverage the benefits of vertical integration.

Since IRC 280E affects the various verticals differently, some cannabis companies are able to isolate activities within distinct business units and maximize Cost of Goods Sold (COGS) calculation to mitigate the impact of IRC 280E.

The potential downside is two-fold. First, IRS tax court cases have made it clear that isolating business units is not a universal solution. And secondly, if not optimally established and documented, transactions between the business units can be problematic and create issues with the IRS.

This article breaks down the impact of IRC 280E, demonstrates the potential benefits of vertical integration, and describes how a proactive transfer pricing strategy can help you maneuver the specific tax and regulatory considerations that affect the industry.

What IRC 280E means for your tax liability

Section 280E penalizes traffickers of Schedule I or II drugs by prohibiting the deduction of “ordinary and necessary” business expenses after reducing gross receipts by COGS, essentially resulting in your federal income tax liability being calculated based on gross income, not net income. For a cannabis operator, COGS typically consist of the cost of acquiring inventory by purchase or production.

Not only are these cannabis companies facing high federal taxes, but there is now an intense level of scrutiny in both federal and state tax audits on intercompany arrangements.

Impact of vertical integration on IRC 280E calculations

Many cannabis companies have become vertically integrated, i.e., combining production function (i.e., cultivation and manufacturing) of cannabis with retail or resale (i.e., distribution) or sometimes all three. Since Section 280E is directly related to selling or the "trafficking" of cannabis-related products, it has the biggest potential impact on retail operations. This means that if a producer can support a higher selling price to its retailer, the retailer will have more COGS from the producer, and the producer will have more costs to deduct because of the allowance of indirect costs.

The business motivation for vertical integration is to better control the supply chain and the end user’s experience. From a tax perspective, cannabis taxpayers want to dis-integrate activities subject to 280E from those for which a position can be argued that they are non-280E activities, such as management services. The Internal Revenue Service (IRS) uses transfer pricing to challenge such segregation and to make allocations between or among the members of a controlled group.

How a transfer pricing study can help your cannabis business

Whether its receives the recent budget infusion or not, the IRS is likely to conduct more transfer pricing audits of the cannabis industry, compared to other industries. These audits frequently result in much higher tax adjustments and significant penalties. In addition, since several states have had budgetary shortfalls due to COVID-19 and other factors, multistate businesses are more frequently being audited by individual states’ tax authorities. If your business has international or domestic intercompany transactions, you’re facing a difficult and uphill battle amid current local, state, and federal tax regulations. The best defense against an IRS transfer pricing audit is a comprehensive transfer pricing study.

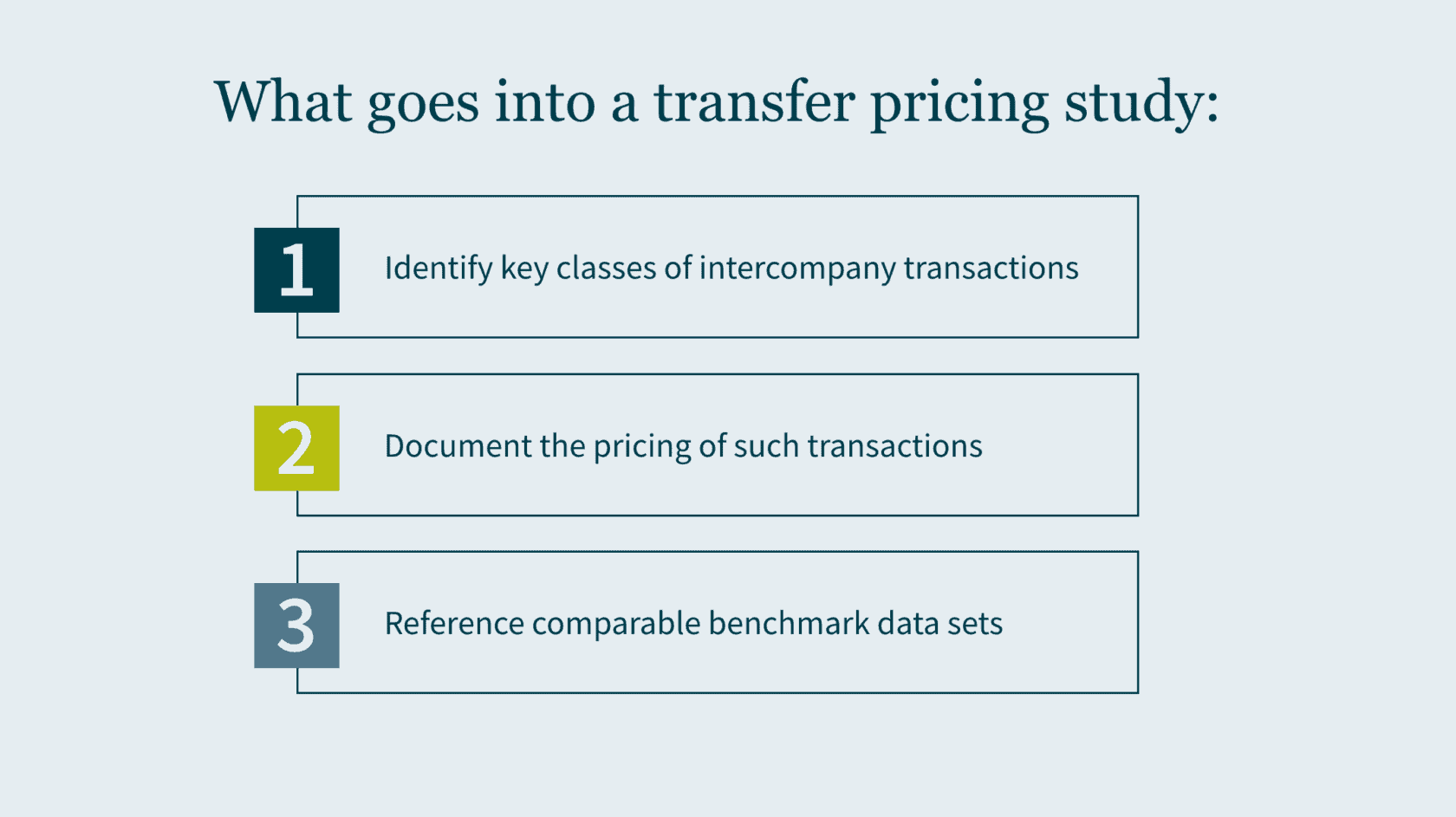

A robust transfer pricing study provides the basis with which a company can refute and push back against federal and state claims that their intercompany transactions have no economic or operational substance. As part of a transfer pricing study we will work with you to identify key classes of intercompany transactions, document the pricing of such transactions and reference comparable benchmark data sets to support qualifying transactions. Where transactions fall outside norms, we will work with you to identify differentiating characteristics and seek other data if available, or recommend policy and pricing changes, along with an assessment of the potential exposure.

Taxpayers with inadequate or out of date transfer pricing policies risk an increased likelihood of controversy and transfer pricing adjustments. Thus, even if you have had a transfer pricing study performed in the past, it is important to have it reviewed and updated.

While a transfer pricing study directly reduces a company’s risk of tax assessments and liabilities resulting from tax audits, they also indirectly reduce execution risk when a company is considering an M&A transaction, a capital raise, or go public transaction.

How MGO can help you integrate transfer pricing for the cannabis industry

MGO’s transfer pricing practice has significant experience with the various transfer pricing concerns of the cannabis industry. We also work closely with our federal and state tax practices to assist many cannabis companies with their specific tax and regulatory considerations, which include:

- Section 280E disallowance of ordinary business expense deductions;

- Common supply chain concerns for operators, like state restrictions on inventory and separation of cannabis and industrial hemp;

- Non-plant-touching structures that operate independently from the 280E-affected business lines; and

- Sales and excise taxes specific to the cannabis industry.

To learn more about how we can help support establishing, optimizing, and documenting transfer pricing policies so your business can grow in this dynamic industry, contact us.